As an investor, I’m always looking for the best ways to grow my wealth safely. Recently, I re-read Richer, Wiser, Happier by William Green for the third time, and it reminded me why ETF investing is one of the best long-term investment strategies for the US stock market.

One of the most insightful chapters covers Howard Marks and the Efficient Market Theory. There’s a joke Marks often shares:

A finance professor and a student are walking through the Chicago campus. The student spots a $5 bill on the ground and excitedly exclaims, “Look! A five-dollar bill!” The professor, without stopping, replies, “That can’t be real—if it were, someone would have already picked it up.” He walks away, so the student picks up the money and buys himself a beer.

Marks even carries a folded $5 bill in his wallet as a reminder that markets aren’t always perfectly efficient. However, he also points out that highly efficient markets—like large-cap US stocks—rarely offer obvious bargains because they are constantly analyzed by professional investors.

Why I Invest in ETFs for the US Market

This is exactly why I’m a long-term believer in ETF investing in the US stock market.

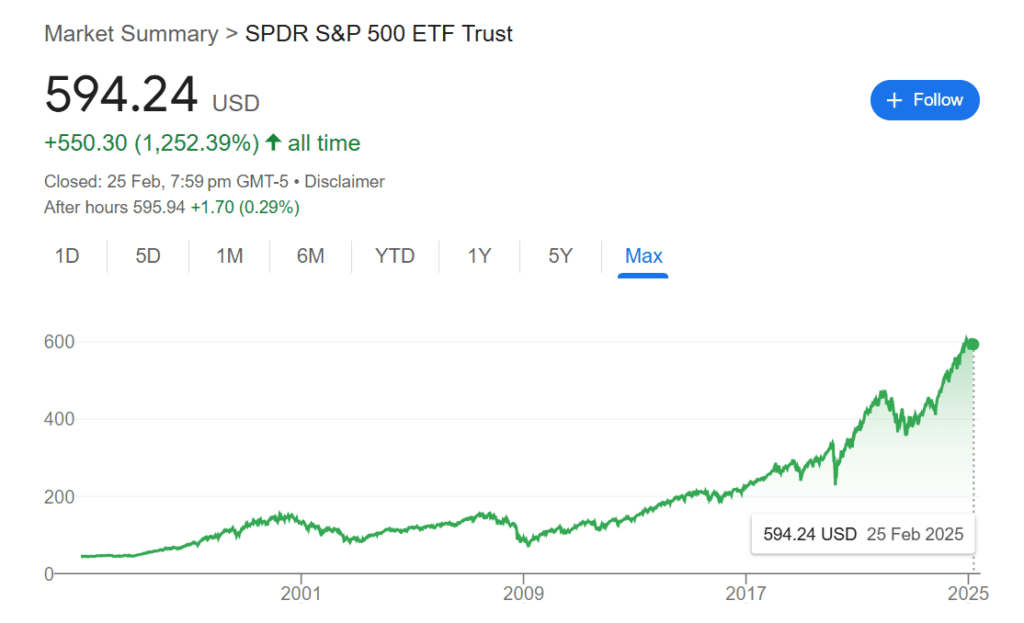

Since large-cap US stocks operate in one of the most efficient markets, finding consistently undervalued individual stocks is difficult. Instead, the best approach is to buy and hold index ETFs like the S&P 500 ETF. This allows investors to benefit from long-term market growth without having to beat Wall Street’s top analysts.

I don’t expect 50-100% yearly gains from investing in low-cost ETFs, but historically, well-selected ETFs have delivered 12-20% annual returns. More importantly, this strategy gives me peace of mind knowing my wealth is growing steadily and safely.

ETFs for International Markets: China and India

Beyond the US, I also invest in ETFs for emerging markets like China and India. These economies have high growth potential, but they are less efficient than the US market. This means there are still opportunities for long-term gains, and ETFs allow me to gain exposure without the need to research individual stocks.

Boosting Returns with ETF Options

For those looking to enhance returns further, I also use options strategies on ETFs. This is what I call the Arigato Investing Strategy—a peaceful, worry-free, and long-term compounding approach to wealth building.

How to Build Wealth with ETFs

If you want to learn how to use ETFs to build a safe and growing investment portfolio, check out my free 2-hr masterclass on ETF investing and options strategies (the majority of my million-dollar portfolio is in ETFs!):

Final Thoughts: Invest with Confidence

Investing isn’t about chasing the next hot stock or trying to outsmart the market. It’s about building a strong foundation, making smart long-term decisions, and allowing compounding to work in your favor. ETFs provide a simple yet powerful way to achieve financial security while minimizing risks.

Howard Marks’ insights remind us that while markets are efficient most of the time, opportunities do exist for those who stay patient and prepared. If you’re interested in learning more about the wisdom of great investors, check out my exclusive interview with William Green where we dive into key investing principles.

Would like to learn about ETF Investing.