On July 27, the Federal Reserve announced another big rate hike, raising the federal funds rate by 75 basis points (bps), to a range of 2.25% to 2.5%. What happens when Fed raises rates? And how does it affect the stock market?

By now you would have already noticed, that the market has been badly impacted, with S&P500 dropping more than 16% since the beginning of 2022! Are investors like you and me in trouble now? Should we sell off our stocks before the bear market crashes even further? If you want to find out the answer, then keep on reading!

Ever since the end of last year, the market has been really volatile as the Fed has announced that they are going to increase the interest rate. Lately, the Fed just made another announcement that they are going to raise the rate by 75 basis points (bps), to a range of 2.25% to 2.5%.

Their main goal is to cool the economy and bring down inflation. In fact, for the past 12 months, the Consumer Price Index rose 8.5 percent. With the recent news of OPEC cutting oil production, energy prices may experience more pressure in the near future.

What happens when Fed raises rates — Perceived Impact

With Fed increasing the rate, borrowing cost is going to increase, making it more difficult for businesses to borrow money for expansion. On top of that, businesses also need to pay more interest on their debts, thus decreasing their earnings, making the current valuation not sustainable. As the result, investors are feeling panic right now as they are afraid that the market is going to drop further.

However, is this assumption actually true? Let’s take a look at the historical track record of the relationship between interest rate hikes and market performance.

What happens when Fed raises rates — Actual Impact

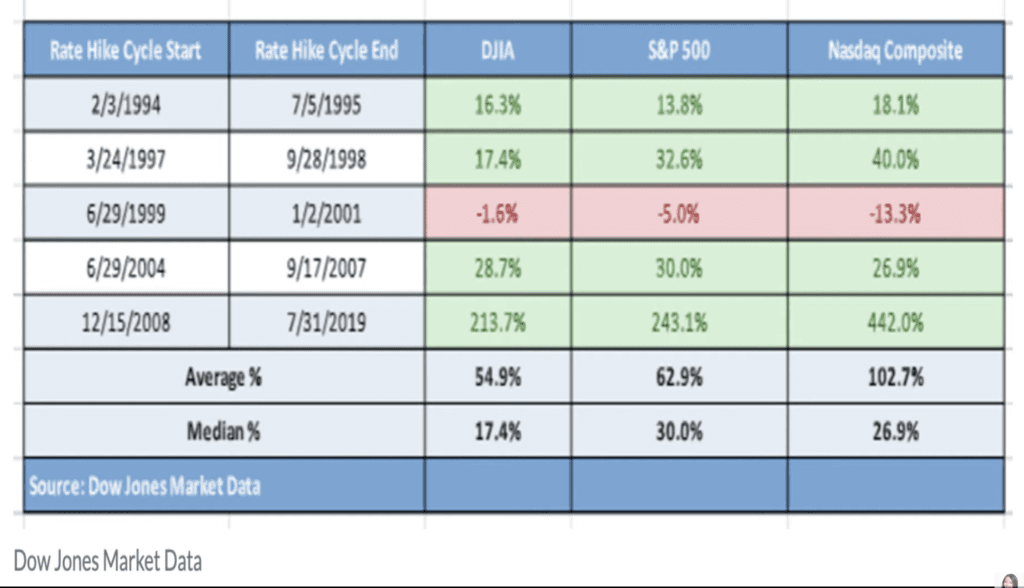

As seen in the chart above, based on the past 25 years of data, during so-called rate-hike cycles, the market tends to perform strongly, not poorly!!

In fact, during a Fed-rate-hike cycle, the average return for the Dow Jones Industrial Average DJIA is nearly 55%, that of the S&P 500 SPX is a gain of 62.9% and the Nasdaq Composite COMP has averaged a positive return of 102.7%!!

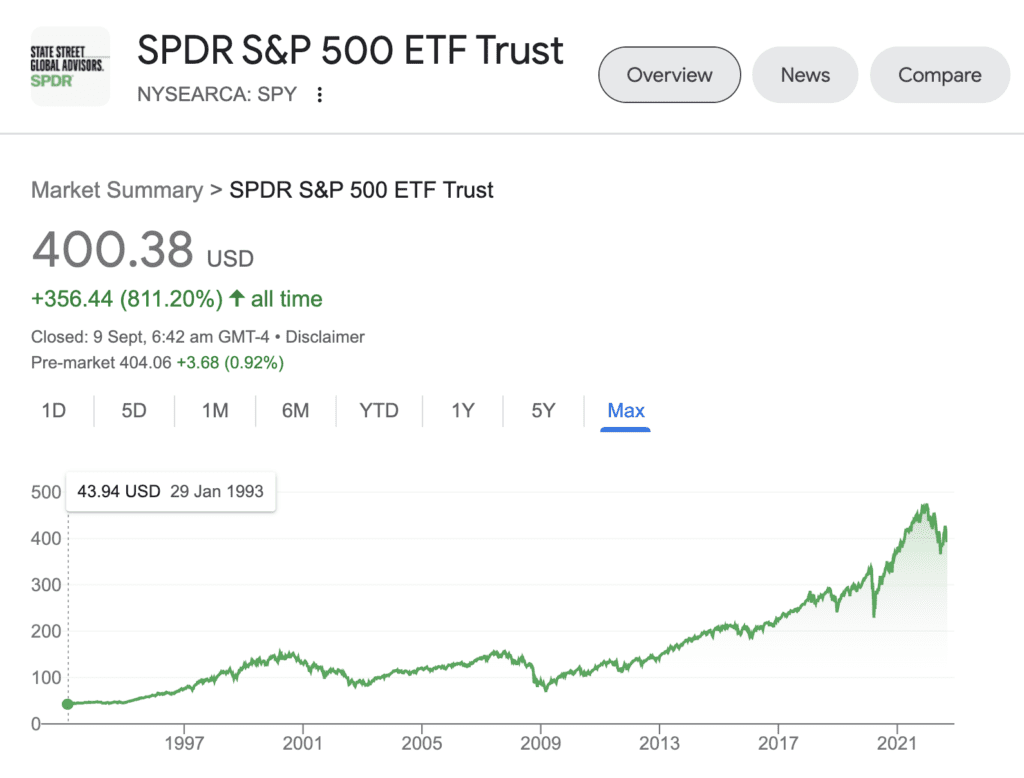

Out of 25 years of data, and 5 rounds of the Fed-rate-hike cycle, only 1 cycle between 1999 and 2001 had a drop, and the drop is not even significant! And if you don’t time the market and continue to invest regardless of the rate-hike cycles, your return will be a whopping 800% since 1993.

And if you invested your $100,000 back then 28 years ago, you would have already become a millionaire, without you doing anything then just letting the SPY grow your wealth for you!

And if you combine with options power, your return would have gone through the roof with what is options call strategy I shared in the post!

So what’s the moral of the story? Don’t time the market and invest for the long term to compound your wealth! Most importantly, invest in strong businesses with strong pricing power and manageable debt, so that they can continue to charge more for their services and not be significantly affected by the upcoming rising interest rate!

In fact, I have been buying some great businesses at undervalued prices lately, as the market is giving me tremendous opportunities. If you want to access my own private portfolio watchlist and see what kind of stocks am I buying at what price, using what strategies, then make sure you sign up for the MooMoo brokerage platform.

Right now, they are even giving away 1 FREE AMAZON share when you fund your account with $2700 SGD! This month is likely to be the last month Moomoo is giving away Amazon stock for free. So make sure you take action right now to grab the bonus gift with my link!

Once you register and fund your account, all you need to do next is to submit your moomoo id to me via the google form, and I will send you my latest portfolio watchlist to your inbox in the next 1 week!

And if you are wondering what options trading strategies really work, do check out the rest of my learning resources in this website. In the meantime, do join my telegram channel too so you can stay up-to-date of my investment insights!