Warren Buffett investment quotes always provide timeless learnings for investors, especially during volatile times like this. With the recent stock prices dropping drastically from their all-time high, if your portfolio is in red right now, and you want to learn exactly Warren Buffett’s way of investing, so you can start making money safely, then you will find this post useful.

When it comes to investing, Warren Buffett says: “Managers and investors alike must understand that accounting numbers are the beginning, not the end, of business valuation.”

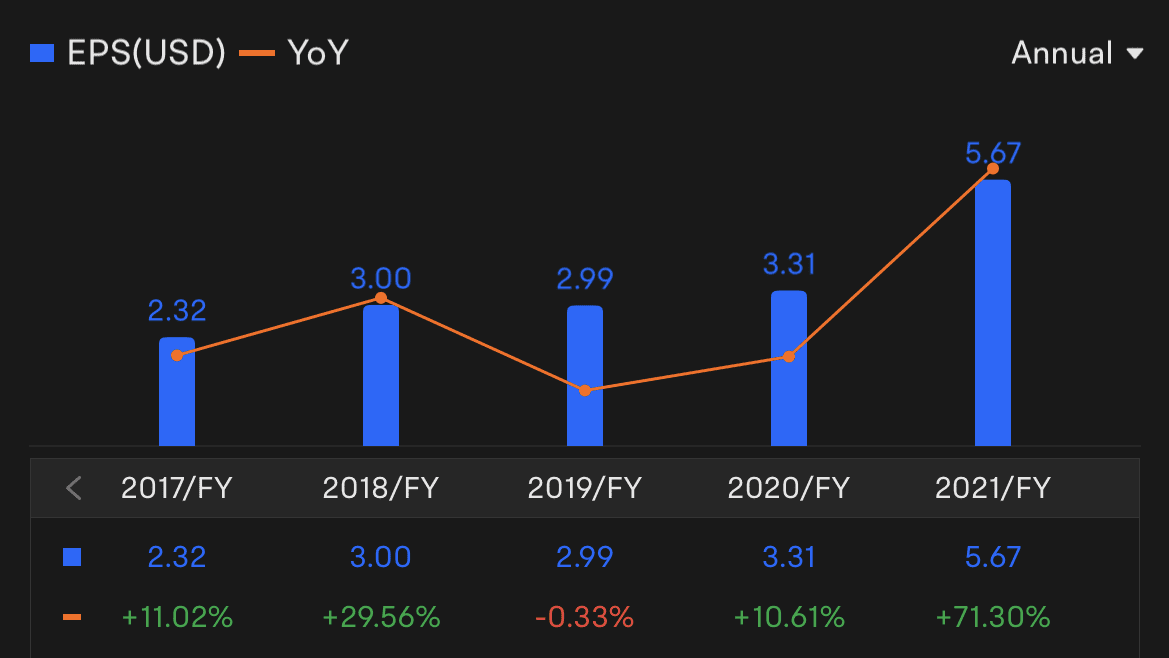

And one of the first accounting numbers you need to learn is Earnings Per Share.

Lessons from Warren Buffett Investment Quotes 1 – Earnings Per Share

Earnings per share (EPS) serves as an indicator of a company’s profitability. Is the company making money, or it’s losing money? It is calculated as a company’s profit (net income) divided by the outstanding shares of its common stock. Warren Buffett always advocates investing in businesses that are predictable. And consistent earnings are a sign of great business.

For example, if you look at Apple, Warren Buffett’s largest holding, it has very consistent EPS, with stable and growing EPS year after year.

And if the business does well, in the long term, the stock price follows. That’s why you can see the stock price of Apple has been growing consistently to over 315% over the past 5 years.

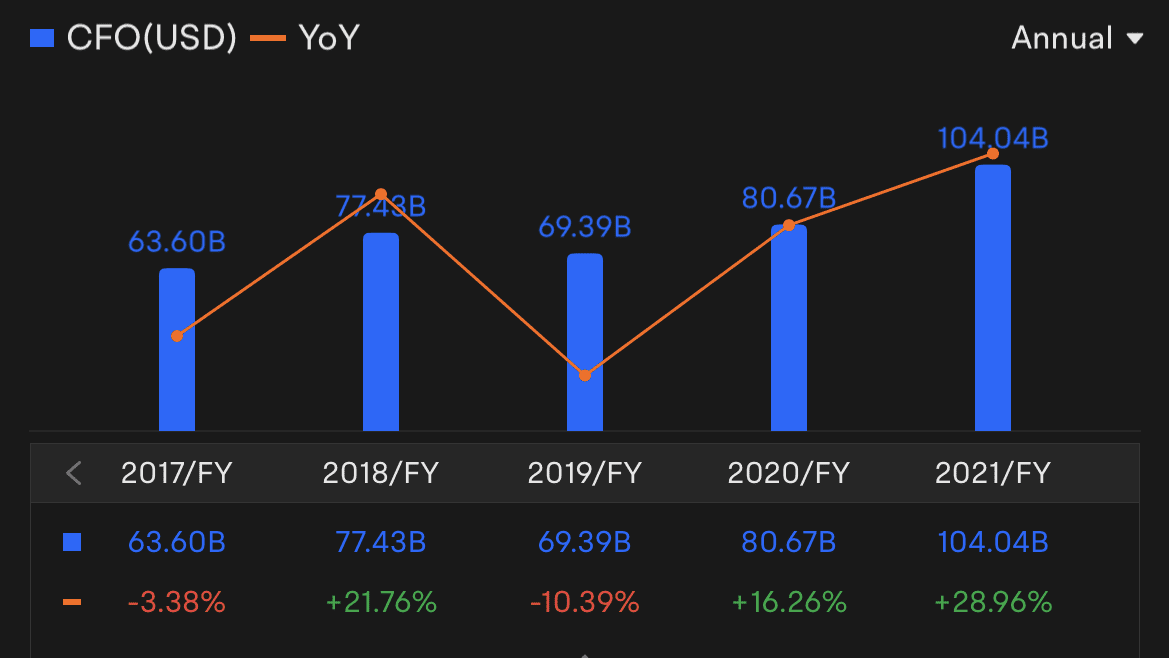

Lessons from Warren Buffett Investment Quotes 2 – Operating Cashflow

Once you found a company with a lot of profits, your research shouldn’t just stop there. You also need to look at its Operating Cash Flow. Because there are companies who like to cook the book and make their income statement look extremely nice and profitable, but in reality, the company is unable to produce any cash flow from its day-to-day operation. And we all know that cash is king. It is the blood of the business. If the business is unable to generate cash flow, it will eventually go into bankruptcy, just like what happened to Hyflux, which declared multi-years of consistent revenue, but in reality, the company has been facing negative Operating Cash Flow for years.

Operating cash flow (OCF) is a measure of the amount of cash generated by a company’s normal business operations. And in order to make sure we are investing in a good company, the OCF must be positive and even better, growing!

From the moomoo app, you can see that Apple has consistent and growing OCF too! No wonder it is Warren Buffett’s favorite company!

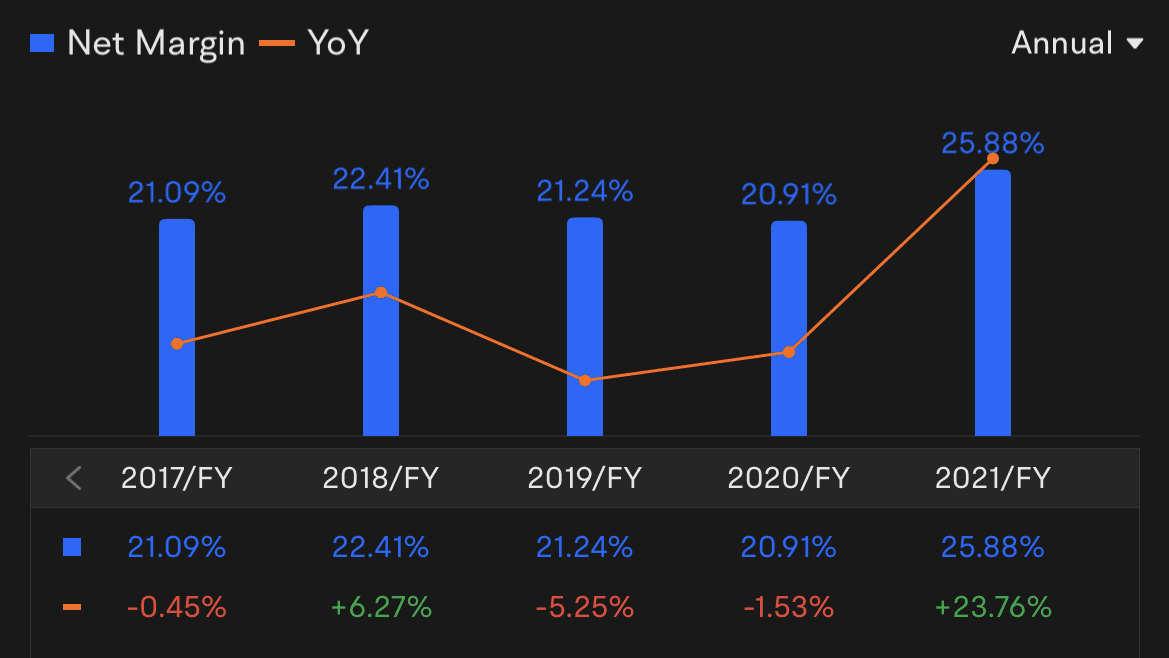

Lessons from Warren Buffett Investment Quotes 3 – Net Margin

Once you checked the OCF of the company, the next you want to see is if the company has a good net profit margin.

Why? With inflation rising like crazy and the FED continuing to increase the interest rates, it is likely that we are going to enter a recession. When that happens, people will start to cut spending, and businesses with low-profit margins will suffer the most, as their sales will decrease when people spend less. And because their businesses have low margins, there will be a direct impact on the bottom line of the companies. In order to survive, they will be forced to cut prices further to attract customers, thereby reducing their margin even further.

This vicious cycle can drive many businesses out of business, which was a common scene during the covid-19 pandemic where many restaurants and retail stores chose to shut down as their margins just couldn’t sustain anymore.

The net profit margin, measures how much net income or profit is generated as a percentage of revenue. We want it to be a minimum of 10% and even better, more than 20%. As you can see from the moomoo app, the Net Margin of Apple remains to be consistently above 20%, showcasing how strong this company is in its pricing power through strong branding. Warren Buffett always loves to invest in strong businesses that people are willing to pay for even though it’s expensive.

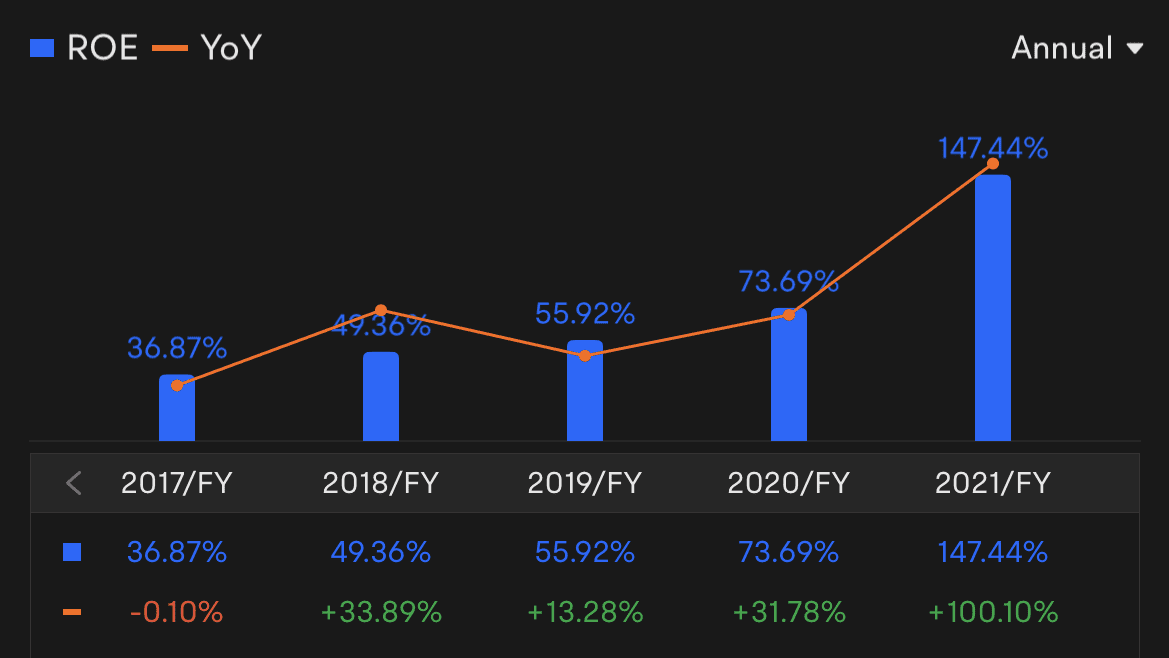

Lessons from Warren Buffett Investment Quotes 4 – Return On Equity

Here comes Warren Buffett’s favorite ratio – Return on Equity, which signifies how efficient the company is in producing profits for its shareholders.

It is calculated as net income divided by shareholder’s equity. We all know that shareholder’s equity belongs to shareholders like you and me. So we want to make sure the company is using our investment efficiently to generate profits. In short, it helps investors understand whether they’re getting a good return on their money, while it’s also a great way to evaluate how efficiently the company can utilise the firm’s equity.

Just like all the other metrics, the different industry has a different benchmark for ROE, but a general rule of thumb is, that if ROE is above 15%, it means the company is generating profits efficiently. As you can see from Apple using the moomoo app, its ROE has been consistently above 15% for many years.

Lessons from Warren Buffett Investment Quotes 5 – Valuation

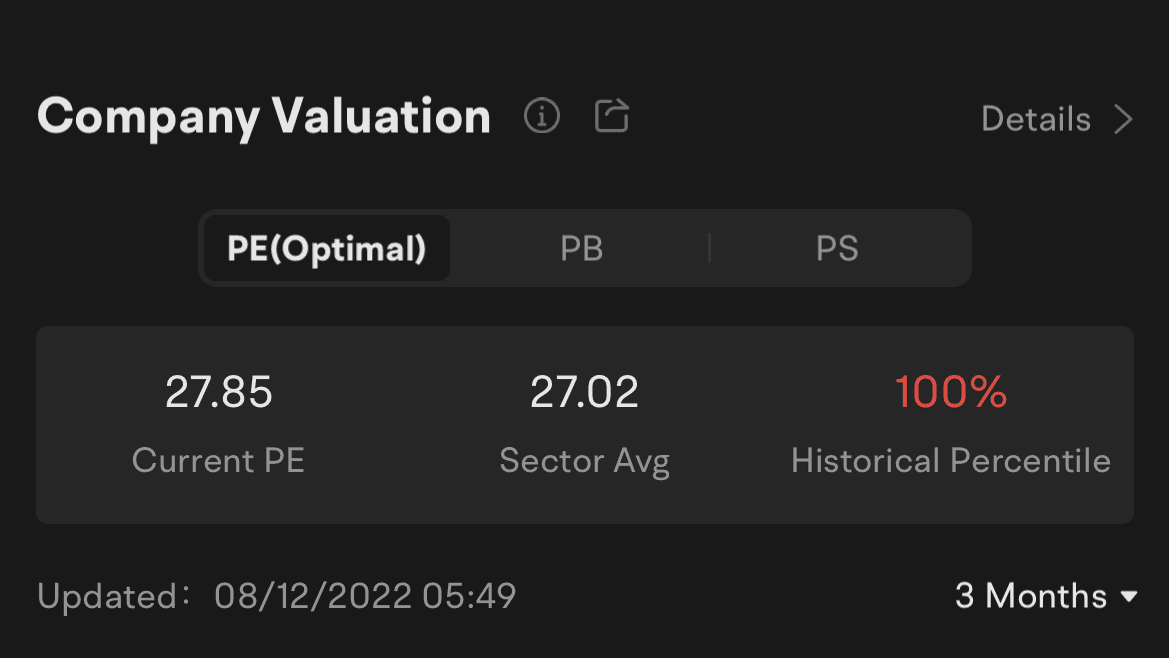

Just like what Warren Buffett said, value investing consists of 2 key concepts. Good company and good price. So after analyzing that Apple is a good company, we then need to ask, if it is a good price to buy right now. That’s why now, we must learn to valuate a company. There are many valuation metrics to use, so I am going to teach you one valuation method that most professional fund managers use, which is the PE ratio.

The price/earnings ratio, also called the P/E ratio, tells investors how much a company is worth. The P/E ratio is simply the stock price divided by the company’s earnings per share for a designated period like the past 12 months. The price/earnings ratio conveys how much investors will pay per share for $1 of earnings.

Right now from the moomoo app, the PE ratio of Apple is 27.85 times, which is higher than its sector avg of 27.02 times. So it may not be the best time to buy into Apple right now because it’s more expensive compared to its peers.

On the other hand, Meta Platforms only has a PE ratio of 12, which is lower than its sector avg of 19.87 times, showing that it is potentially a buying opportunity!

So here are the 5 important metrics you should start looking at before investing in any stock! Remember, Value investing is a powerful method that Warren Buffett has been using for years to compound his wealth. What I am sharing here is just the tip of the iceberg.

I highly recommend you to read further into books about Warren Buffett, such as the Buffettology written by my personal mentor Mary Buffett, who learned directly from Warren Buffett, to truly understand the beauty of value investing.

And if you know how to combine options with value investing, that’s when you are able to increase your return even further! If you want to learn more about options, do join us in our free options foundation class!

And if you want to sign up for moomoo to start your stock and options investing journey, you can do so via here. You will even get free shares when you fund your account with $2700 SGD, and I will also send you my private portfolio watchlist to your inbox! All you need to do is to fill up the google form once you signed up and funded your account with my link earlier.

If you also want to learn what options trading strategies really work, and how you can use options call to increase your return, check out some additional learning resources in my website. Happy investing and happy learning! In the meantime, I also made a video sharing with you the top 5 investing metrics used by Warren Buffett. Check it out!