Applying Charlie Munger’s Psychology to Investments – Avoiding Psychological Pitfalls (Part 2)

In Part 1 of this series on Charlie Munger’s investment psychology, we explored 12 psychological tendencies that influence our investment decisions. These insights from Poor Charlie’s Almanack reveal how deeply ingrained biases can subtly guide our actions, often without us realizing it. Understanding these psychological pitfalls helps us make wiser choices that align with long-term […]

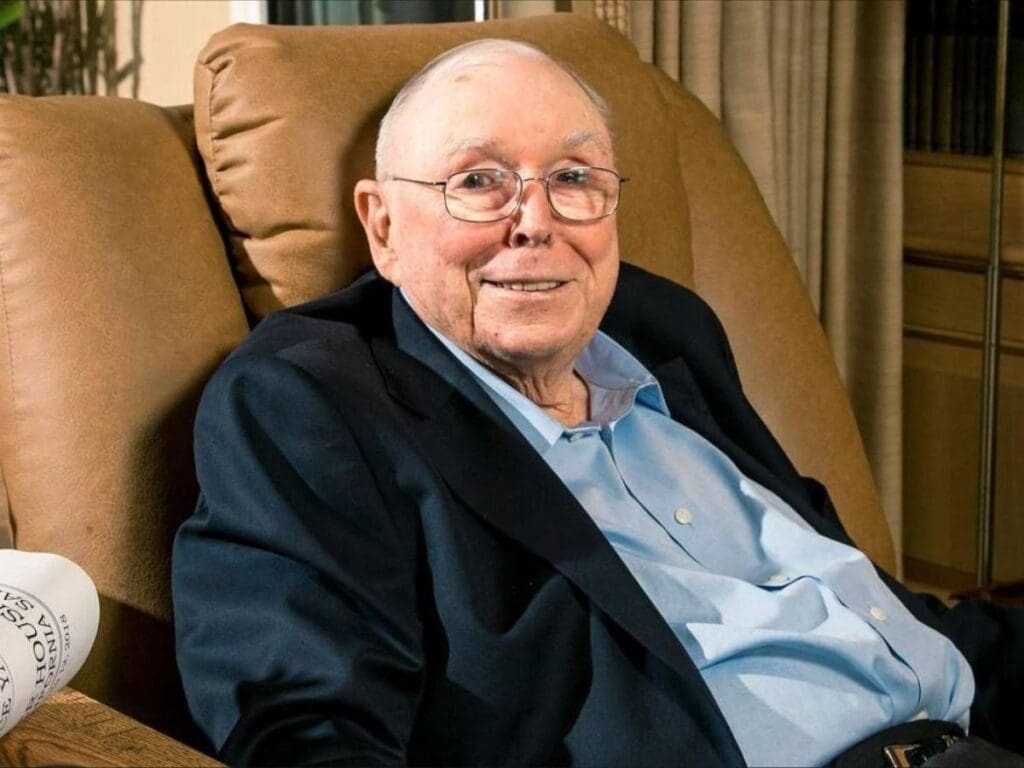

Charlie Munger’s Investment Psychology – Understanding the Psychological Biases in Investing Decisions (Part 1)

In the world of investing, few figures inspire as much admiration as Charlie Munger, Warren Buffett’s trusted partner and former vice chairman of Berkshire Hathaway. Munger’s approach to investing goes beyond numbers—he dives deeply into investment psychology to understand how our natural biases influence our decisions, often without us realizing it. In the book, Poor […]

Why did Charlie Munger Give Li Lu $88m?

This morning, I was reading Li Lu‘s book, and I came across a powerful illustration of how trust is built. In Li Lu’s book, he detailedly talked about the encounters with Charlie Munger in his life. He first met Charlie in 1996, but he only managed to have a chance to have a heartfelt talk with […]

What I learnt from Mohnish Pabrai: The Warren Buffett of India

With Berkshire Hathaway AGM coming to an end, I felt so fortunate to be able to learn and meet from so many brilliant investors all over the world. They’ve showered us with immense wisdom and kindness, helping us on our journeys to becoming better investors. I will be writing a series of reflections along the […]

7 lessons I’ve learned from Charlie Munger

As I’m re-reading the chapter about Charlie Munger inside “Richer, Wiser, Happier” by William Green, I can’t help but feel in awe of how much I can learn from this legend by studying his words again. Here’s the summary of the 7 lessons I’ve learned from Charlie Munger. **1. Be Humble and Avoid Being Foolish** […]