Many of you asked me on my Tik Tok and Telegram channel, saying that you are a complete beginner, and you are wondering what are the stocks for beginners to buy. And how you should start investing safely? That’s why I decided to dedicate this post to sharing with you step-by-step, how you should start investing. Basically, these are the advice I wish someone else could have given me when I first started many years back.

And if you listen to my advice and start taking action accordingly, I promise you that you will be able to achieve your financial freedom goal much much faster!

I know by now you would have realized that everything around you is getting more and more expensive. Your coffee now cost over a dollar more compared to a few years ago. Your petrol price is shooting up like crazy as if you are pumping liquid gold into your car. Property price is painfully increasing year on year, and the dream of getting your own home just seems further and further away!

And that’s why you want to start investing, because by now you would have realized that, if you continue to put your money in the bank, the value of your hard-earned money will ONLY DEPLETE MORE AND MORE, FASTER AND FASTER over time!

I get it. We all get it. But the key is, how to make money work hard for us? How should we invest so that we don’t accidentally burn away our hard-earned savings?

The answer lies in the ability to invest in stocks that are of quality businesses and also buy them at the right price. But before that, I want to address what are stocks, and how you make money from stocks, for those who are completely new to investing!

1. What are stocks and how do you make money from stocks?

A stock is a security that represents ownership of a company. Eg, when you purchase an Apple stock, you’re purchasing a small piece of the Apple company. And when Apple sells more iPhones and iPad and makes more money, you as a shareholder will be rewarded over time, in the form of:

- Dividend

When a company makes money, it can choose to distribute some profits to shareholders in the form of dividends, and it can be a good thing for investors like us because it’s passive income!

- Capital gain

Another way of making money from stock is to enjoy the capital gain. Imagine if you first invested in Apple back 5 years back at $40 per share.

If you hold onto the stocks, today your $40 a share would have become over $170 a share, a whopping 330% return in a short 5 years!

That means if you invested $10,000 back then, your $10,000 would have turned to more than $33,000 by now! That’s a pretty decent amount for capital gain, isn’t it? Not to mention the consistent dividend payout by Apple for the past 5 years 🙂

- Options

You can also make money through stock options. There are hundreds of options strategies out there, but there are only a few that are proven to give consistency. If you are wondering what options trading strategies work, depending on if you are looking for income or growth, you can choose to become an options seller, which generally gives you a 2-3% return per month, using options strategy like Strategy B.O.S.S.

If you are looking for growth, you can become an option buyer through Strategy X, and get a double-digit return to even a potential 3-digit return! Here are just some of the options trades I took on great companies like Microsoft or indexes like SPY. I actually wrote a post about what are options call and how you can use it to accelerate your return. Check it out to learn!

Stocks for beginners to buy

Now the next question is, you know investing in stocks is powerful, but what are the stocks for beginners to buy?

In order to make sure you don’t buy into lousy companies, you need to spend time researching the businesses, to see if it’s making money, does it have a healthy margin and more. And most importantly, you want to make sure you buy them at a fair price or even better, a good bargain price.

Because once you are able to do that, and given time, your portfolio will definitely grow and compound massively over time. Just look at how many amazing companies like Google, Apple, Microsoft, and Tesla have tripled and quadrupled over the past 5 years. I highly recommend you to read the lessons from Warren Buffett investment quotes to learn 5 key important metrics before investing in any company.

But you might be thinking: “I am a complete beginner, so how am I supposed to know how to study these companies in depth and buy them at the right price? What if I make mistakes and pick the wrong stocks to buy?”

It’s a great question! That’s why what I am going to share with you next, can greatly help you to reduce your risk of picking the wrong stock, and also help you to save lots of time. You don’t need to spend hours and hours studying the companies to know which one is good to buy, and be afraid that picking the wrong stock will make you lose money anymore!

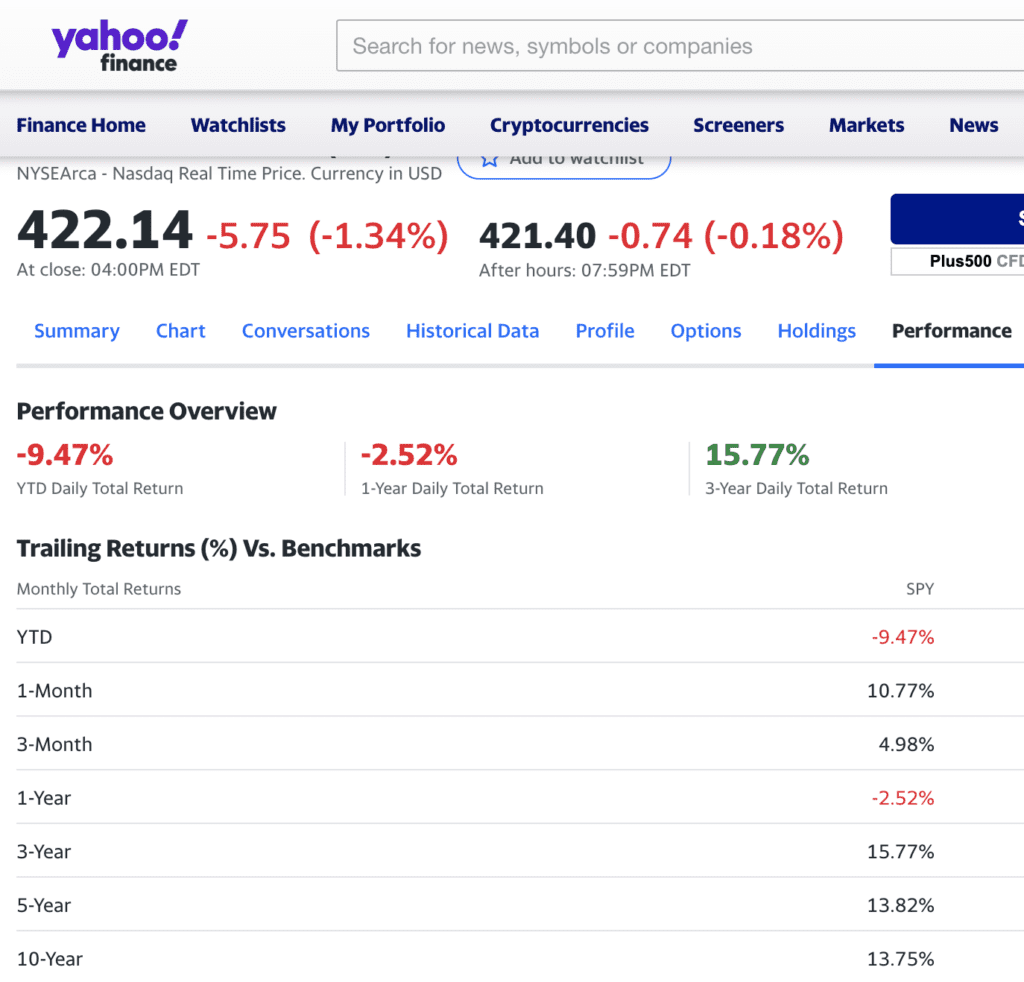

All you need is to invest in SPY ETF, the exchange-traded fund that tracks the top 500 companies in the US.

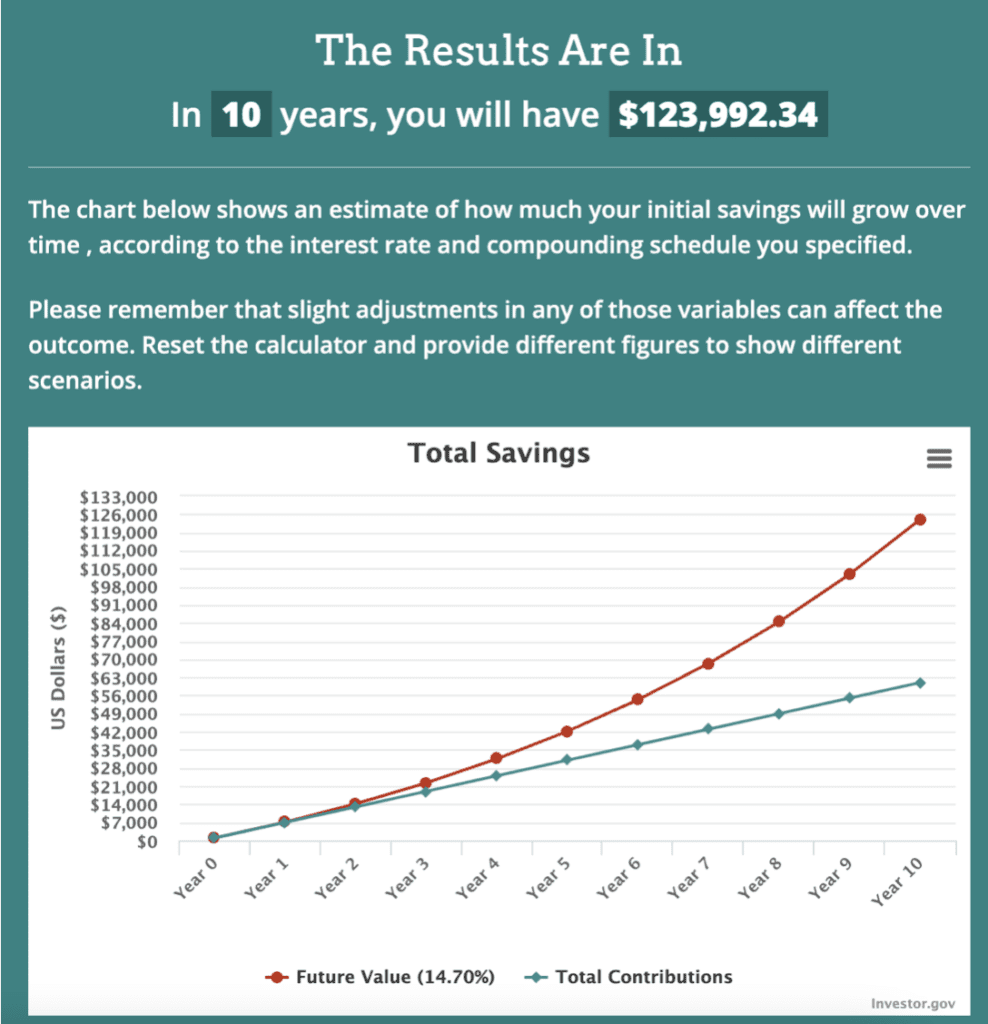

By simply buying SPY ETF, your annualized return is about 14% for the past 10 years. That means if you only invested $1,000 initially and continue to invest $500 every single month, your money will grow to more than $123,000 in 10 years’ time!

But if you are wondering, isn’t investing risky? I heard my father used to tell me my uncle/auntie used to lose lots of money in the stock market, and my father’s uncle’s uncle also got his savings wiped out due to the stock market, and my auntie’s uncle’s father… enough!

I know you have heard of this kind of story multiple times and that has deterred you from taking action. But very often than not, the reason why all your relatives seem to be losing money is that they don’t know anything about investing. They are more like gambling and doing short-term trades which they don’t know have the right skill set and mindset to do so.

However, if you are investing in something safe like SPY, you are immediately diversifying your risk to 500 top companies in the US, which includes Microsoft, Google, Apple, and more!

And if any one of the businesses is not performing well, they will be kicked out from this ETF, and be replaced by the next winner.

So you are always investing in safe businesses that are growing, and so will your wealth over time!

So if you invest your money in the market for the long run, you will make money! The worst thing you can do is not to invest your money, and your hard-earned savings are being robbed away by inflation…

How much money do you need to get started?

So now, you must be wondering how much money you need. Firstly, you can start as low as $500-$1000 dollar, buying 1-2 SPY shares. Most importantly, don’t just stop there. You need to continue investing. Every month continue to invest another $500 to buy more and more shares of SPY, and let the time do its magic.

The most important thing is to get started now!

Regarding how to get started and buy your first SPY share, you can consider opening up your brokerage account with moomoo, the fastest growing brokerage account in Singapore backed by tech giant Tencent and regulated by the Monetary Authority of Singapore. And yes, Malaysians can open an account easily too!

Right now, moomoo is running a great promotion right now. If you fund $2700 SGD or equivalent in other currencies, you will get a FREE stock such as Amazon, and an additional $40 cash coupon to your account!

I will also be giving you my Private Portfolio Watchlist once you signed up and funded $2700 SGD via my link. All you need to do is to notify me via the Google form so I can send you my watchlist within 1 week.

On top of that, you can do options on moomoo too, thereby increasing your return even more within a shorter time!

Remember the best time to start investing is yesterday. Because the market has gone up so much over the past decade. But since we can’t turn back time, what we can do is start seizing opportunities and start investing today!

For more investing insights, do follow me on telegram because I post constant investment updates over there! In the meantime, do check out the video below as I explained step-by-step how you can buy your first SPY stock using moomoo (skip to 10:00 for this). Enjoy your learning! 😀