You have 100 shares of Tesla and you believe that long-term the stock price will go up, but lately, the stock market is behaving like a see-saw, up down up down, and going nowhere. You are wondering, how can you generate additional potential income while holding onto the Tesla stocks. If you want to generate a potential passive income of approximately 5% safely using selling call options while holding onto your stocks, then keep on learning!

Warren Buffett’s teacher, Ben Graham, who is the father of Value Investing, once said: “In the short-run, the market is a voting machine — but in the long-run, the market is a weighing machine.”

If you have been observing the market, his statement is so so true. Because for the past few months, the market has been acting like a see-saw, going up and down, up and down, leaving many investors clueless regarding what to do in this volatile market condition.

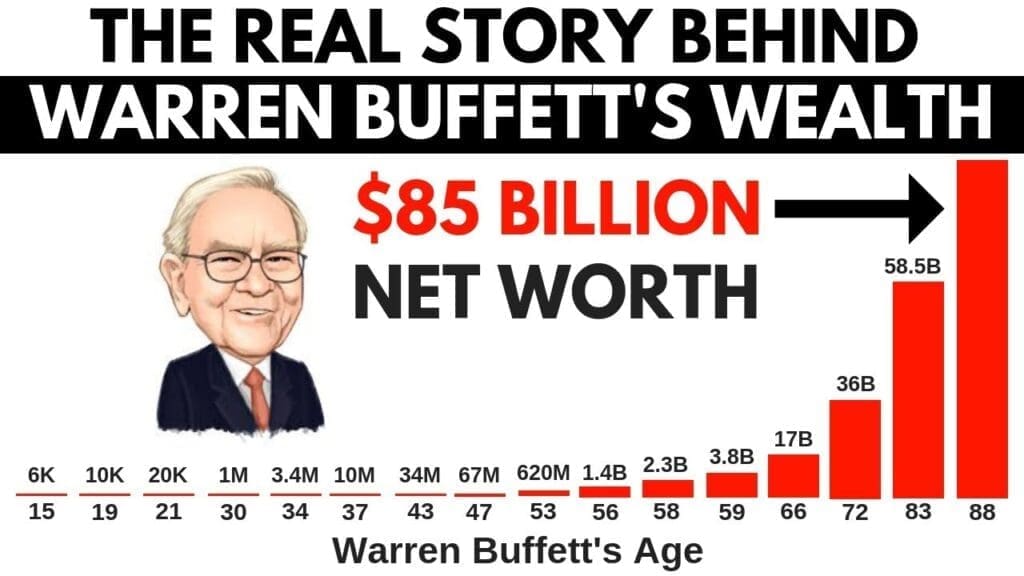

But if you are a true value investor, you will know that if you buy great businesses at great prices, your wealth will go up in the long-term, just like how Warren Buffett has accumulated over $85 billion of net worth through investing by the age of 88.

But the key is, is it possible to generate potential income while holding onto those great businesses? The answer is yes, through the power of selling call options! And in this post, I am going to share with you how you can do that, I will also be using the moomoo brokerage platform to navigate how you can use this selling call options strategy. Let’s get started!

Selling Call Options 101

Options are financial contracts that give investors the right or obligation to buy or sell a stock at an agreed-upon price and date. Just like you can buy and sell a stock, you can also buy and sell an options contract. There are only 2 types of options you need to learn. The first one is put options, and the other is call options.

In order for you to be able to collect potentially more passive income while holding onto the stocks, and potentially generating 5% or more per month, you can consider SELLING CALL options.

When you’re selling call options on a certain stock, eg Tesla, it means that you are making a promise to sell away 100 shares of Tesla at the price that you want. And in return for you making this promise, you get to collect some money called a premium.

To make it easier for you to see, I am going to use moomoo to demonstrate how you can use this options strategy.

Selling Call Options Using MooMoo

As you can see, I already have 100 shares of Tesla inside my brokerage account. I bought the share at about $235 each, and right now I am already in profit of more than 23% as the stock price has risen to $289. But I believe that given time, Tesla will appreciate even more, and that’s why I don’t want to sell away my shares right now at the market price.

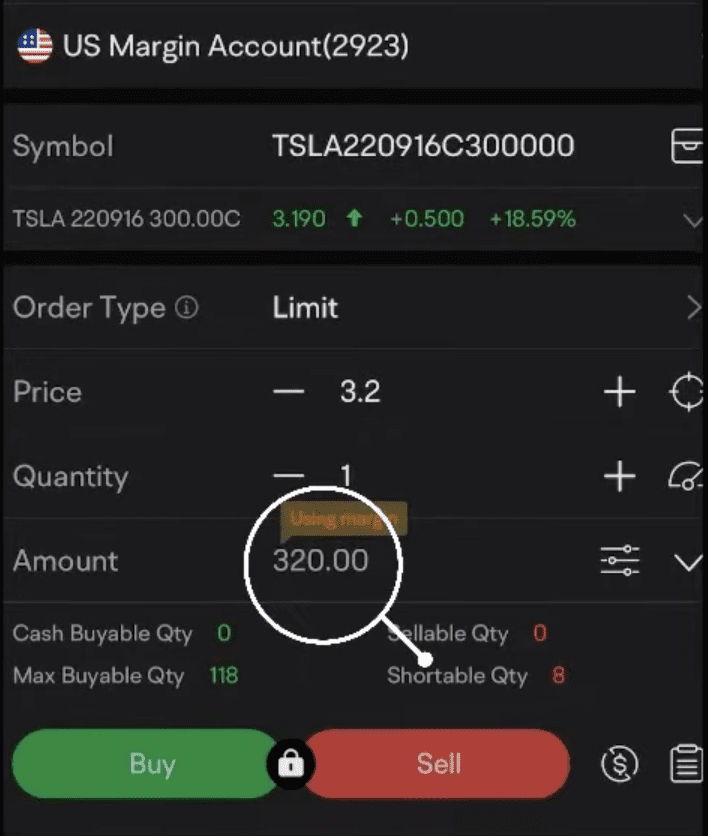

Instead, I want to sell away my shares only when the stock price reaches $300 so that I can profit even more. But instead of just waiting for the stock price to go up and doing nothing in between, I can go and sell a call option at the strike price of $300 and promise to sell away my Tesla shares only when the stock price rises above $300.

By doing that, I get to collect $320 USD of premium, which is my passive income.

And if you want to calculate your Return On Investment, using $320 divided by $23500, which is the amount of money that I used to buy 100 shares of Tesla back then, my Return On Investment is around 1.4% in 8 days!

If you translate to a monthly ROI, this is already above 5%.

Rules For Selling Call Options

If you are wondering what strike price to choose from. You can go +1, +5, or +10, but a general rule of thumb is to choose a strike price above the current stock price, and of course, above your own purchase price of the shares because you only want to promise to sell away your shares at a profit. And for the expiration date, you can sell call options with an expiry date of 1 month or less, and for me, I chose about 1 week, so I can collect passive income week after week.

Most importantly, I want you to remember this rule by heart. Only sell call options, when you actually have 100 shares of the underlying stock. Never ever selling call options without having any shares, because selling “naked” calls without shares is very dangerous!

What Happens After Selling Call Options

Now the next question is, what happens after the selling call options expiry date?

If Tesla stock stays below $300, you will get to keep your 100 shares, as well as your $320 premium collected upfront. But if the stock shoots up to more than $300, let’s say $310, you will still have to keep your promise and sell away your 100 shares of Tesla at $300, which is the price you wanted to sell in the first place. So you get to profit more, as the stock price shoots up to the price you want to sell, plus you get to keep the premium of $320. Isn’t that a win-win situation?

That’s it! You have just learnt how to use sell call options to your advantage to potentially collect more income while waiting for the stock to rise to the selling price that you want! If you are wondering what options trading strategies really work, I also did an in-depth sharing on Dip-Buyer Profit Strategy using Sell Put options previously, and how it can potentially help you to collect 2% income per month. If you want to learn more, do check it out too.

There are many powerful options strategies out there, and I can’t share all of them in this post. If you want to learn how to start investing with options step-by-step, then do join us in our upcoming Next Level Options Masterclass, where we will be sharing with you 3 options strategies for you to take advantage of in different market conditions.

Get Free Share With MooMoo

If you want to sign up for moomoo to start your stock and options investing journey, you can do so here. You will even get a free share such as Amazon when you fund your account with $2700 SGD, and I will also send you my private portfolio watchlist to your inbox! All you need to do is to fill up the google form once you signed up and funded your account with my link earlier.

Do also note that this post is for educational purposes. The stock shared here is not a buy/sell recommendation. Please make sure you do your due diligence before making any investment decision, so you can become an independent investor! Lastly, if you want to stay up-to-date with my investment updates, do follow me on my telegram channel, where I share my daily investment insights!

If you want to understand more about selling call options, I also made a video to share with you the step-by-step navigation below. Enjoy your learning!