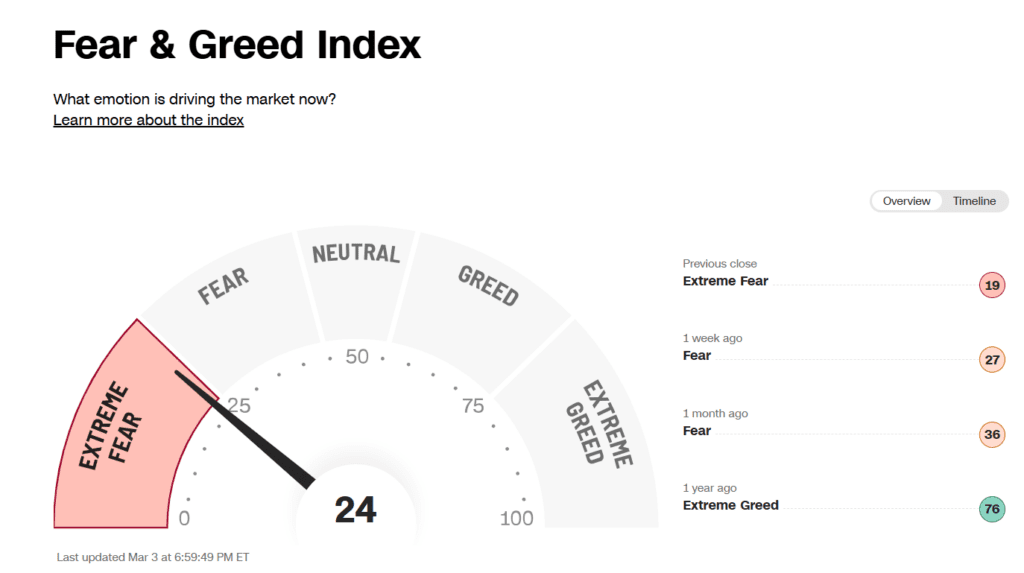

The Greed and Fear Index is flashing extreme fear, and the stock market is feeling the pressure. With Trump’s latest tariff bombshell hitting Canada, Mexico, and China, investors are panicking, and stock prices are dipping.📉

Trump has long maintained that tariffs are a useful tool to correct trade imbalances and protect US manufacturing.

He has largely dismissed concerns that the measures risk economic damage in the US, despite the close ties, especially in North America, where businesses have enjoyed decades of free trade.

“What they’ll have to do is build their car plants, frankly, and other things, in the United States, in which case they have no tariffs,” he added.

But here’s the big question: Should you buy stocks and ETFs now, or wait for a bigger drop?

What is the Greed and Fear Index?

The Greed and Fear Index measures investor sentiment on a scale from extreme fear to extreme greed. When it’s high, people are chasing stocks. When it’s low, fear is taking over, and investors are dumping their holdings.

Right now, we’re in extreme fear territory, meaning many people are selling, and panic is driving market movements.

How to Use the Greed and Fear Index to Invest Wisely

1️⃣ Don’t Panic—Extreme Fear Can Be an Opportunity

Historically, when the Greed and Fear Index shows extreme fear, the market is near a bottom. That doesn’t mean you should rush in, but it does mean that stocks and ETFs might be on sale for long-term investors.

2️⃣ The Market Is Down—But Not Cheap Yet

The S&P 500 has only dropped about 5% from its all-time high, so this isn’t a full-scale market crash. Yes, fear is high, but this isn’t the time to “show hand” and go all in. Instead, be strategic with your buys.

3️⃣ Stick to Your Game Plan & Think Long Term

If you’ve been following me, you know I practice Arigato—staying Zen, calm, buying quality ETFs, and thinking long term. I’ve been gradually adding more ETFs to my portfolio and coaching my private community to do the same.

Best ETFs to Buy During Market Fear

Looking for safe ETFs to buy while the Greed and Fear Index is low? Here are some options:

- Broad Market ETFs: VOO (S&P 500), VTI (Total Stock Market)

- Dividend ETFs: SCHD, VYM

- Defensive ETFs: XLV (Healthcare), XLP (Consumer Staples)

Final Thoughts: Is Now the Time to Buy?

✅ The Greed and Fear Index is at extreme fear, signaling opportunity.

✅ But the market is not extremely cheap yet, so don’t go all in.

✅ Stick to your game plan, think long term, and practice Arigato Investing.

Meanwhile, if you want to learn how to apply the Arigato Investing System and combine ETFs with options investing to accelerate your returns while lowering your risk, check out my Free 2.5-hour Options to Freedom Masterclass.

👉 What’s your game plan during this market dip? Drop a comment below and let me know!