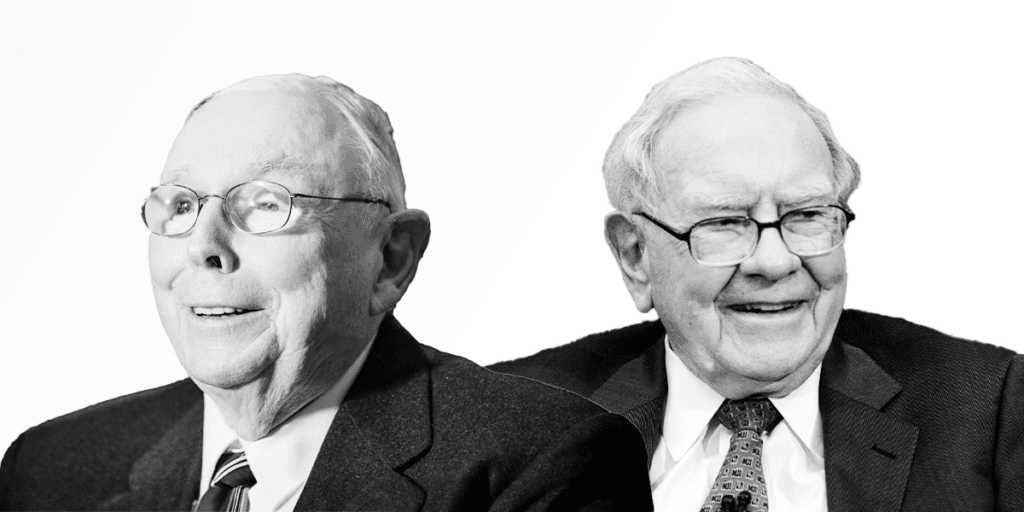

In the world of investing, few figures inspire as much admiration as Charlie Munger, Warren Buffett’s trusted partner and former vice chairman of Berkshire Hathaway. Munger’s approach to investing goes beyond numbers—he dives deeply into investment psychology to understand how our natural biases influence our decisions, often without us realizing it.

In the book, Poor Charlie’s Almanack, Munger discusses 25 key psychological tendencies that impact our judgment. Recognizing these tendencies can help us avoid common pitfalls and become more thoughtful investors. This two-part series breaks down each of these biases, starting with the first 12 here in Part 1. If you’d like guidance on applying these insights, join my free 2-hour investing masterclass and our supportive Telegram community for exclusive tips and insights on mastering the mindset of a resilient investor.

Charlie Munger’s Investment Psychology 1. Reward and Punishment Super-Response Tendency

We’re all highly motivated by rewards and avoid punishment, but in investing, this tendency can sometimes lead us astray. For example, high returns on speculative investments might tempt us to chase similar high-risk opportunities, even when they don’t align with our long-term strategy. Munger stresses the importance of balancing reward with a clear understanding of risk to prevent impulsive decisions that could harm our portfolio.

Charlie Munger’s Investment Psychology 2. Liking/Loving Tendency

It’s natural to favor people, companies, or ideas we like, but in investing, this can cloud our objectivity. In investing, this might mean holding onto stocks of a beloved brand even if the fundamentals are weak. By separating personal preferences from financial analysis, Charlie Munger’s investment psychology helps us make more objective choices that are in line with our goals.

Charlie Munger’s Investment Psychology 3. Disliking/Hating Tendency

Similarly, our dislikes can make us avoid opportunities, even when they’re beneficial. An investor might skip certain sectors or companies because of a personal bias, missing out on valuable diversification. Applying Charlie Munger’s psychology to investments means setting aside personal opinions and focusing on an investment’s real potential.

Charlie Munger’s Investment Psychology 4. Doubt-Avoidance Tendency

Doubt is uncomfortable, so we tend to rush decisions to get rid of it. In investing, this might lead to impulsive buys or sells without proper analysis. Munger encourages us to embrace doubt, giving ourselves time to fully understand before taking action.

Charlie Munger’s Investment Psychology 5. Inconsistency-Avoidance Tendency

Sticking to past choices is human nature, even when those choices no longer serve us. For example, we might hold onto a stock simply because it was once profitable. To learn how to stay flexible, join my Arigato Insiders Newsletter! There, I share exclusive insights, heartfelt reflections, and the timeless principles of Buffett and Munger—helping us all make more thoughtful, confident choices together.

Charlie Munger’s Investment Psychology 6. Curiosity Tendency

Curiosity drives us to explore, which can be beneficial in investing if directed well. But it can also lead to impulsive choices, like jumping into “hot” stocks without research. Charlie Munger’s investment psychology reminds us to keep curiosity disciplined, focusing on strategies grounded in research and patience.

Charlie Munger’s Investment Psychology 7. Kantian Fairness Tendency

Our sense of fairness often affects our perception of value. We might pass on an investment that doesn’t “feel fair,” even if it has strong growth potential. Munger’s principle here is to rely on objective data, not subjective feelings of fairness, in evaluating opportunities.

Charlie Munger’s Investment Psychology 8. Envy/Jealousy Tendency

Comparing our returns to others’ can lead to envious decisions, like taking on unnecessary risks just to “catch up.” Munger’s advice? Focus on your own journey and long-term goals—trust that measured, thoughtful investing will yield the best results.

Charlie Munger’s Investment Psychology 9. Reciprocation Tendency

The urge to return favors, even in investing, can lead to biased decisions. For example, buying a stock recommended by a friend out of loyalty rather than research. Charlie Munger’s investment psychology encourages us to keep personal dynamics separate from financial choices.

Charlie Munger’s Investment Psychology 10. Influence-from-Mere-Association Tendency

We often associate positive qualities with brands or people we admire, which can bias our choices. In investing, this might mean choosing a company based on association rather than fundamentals. Munger’s advice? Make decisions based on facts rather than positive associations.

Charlie Munger’s Investment Psychology 11. Simple, Pain-Avoiding Psychological Denial

When faced with uncomfortable truths about our investments, it’s easy to ignore them to avoid pain. Facing potential downsides early on helps us make more rational choices, even when it’s difficult.

Charlie Munger’s Investment Psychology 12. Excessive Self-Regard Tendency

Confidence is important, but overestimating our own skills can lead to excessive risks. Munger emphasizes humility in investing, reminding us that staying grounded and realistic about our knowledge is a strength.

Conclusion

These first 12 psychological biases highlight how ingrained tendencies can shape our investment decisions, often without us realizing it. By recognizing these patterns, we can start making more grounded, objective choices that align with our financial goals. To dive deeper into applying these principles in your own investments, join my free 2-hour investing masterclass and become part of our Telegram community for daily insights and support from fellow investors.

In Part 2 of this series on Charlie Munger’s investment psychology, we’ll continue exploring the remaining 13 tendencies, offering further insights into avoiding psychological pitfalls. Let’s keep growing and learning together, the Munger way!