I’m Thinking of Investing $100K Into This Brokerage—Here’s Why

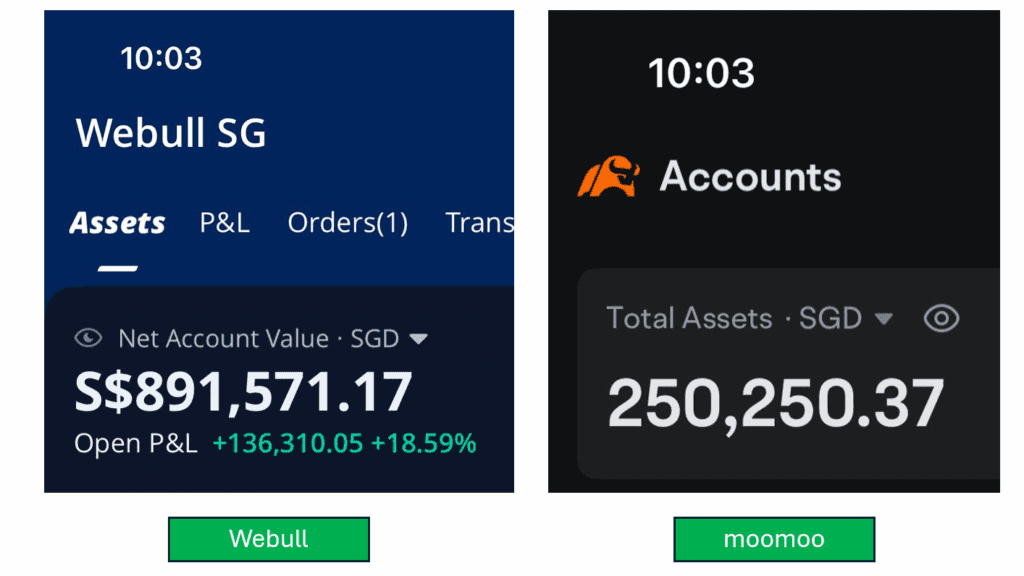

Yes, you read that right. Even though I already have close to $900K SGD in Webull and another $250K+ SGD in Moomoo, investing in stocks and options. I’m now seriously considering parking another six-figure sum into a third brokerage account. Why? Because I recently came across Longbridge Singapore, and their rewards and platform benefits are […]

A story I’ve never told fully…

When I was younger, my grandmother used to water down soap just to make it last a bit longer. She reused every plastic bag, saved every coin, and made frugality a way of life. That mindset shaped me deeply.Even when I started working, I avoided luxury items, rarely dined out, and saved as much as […]

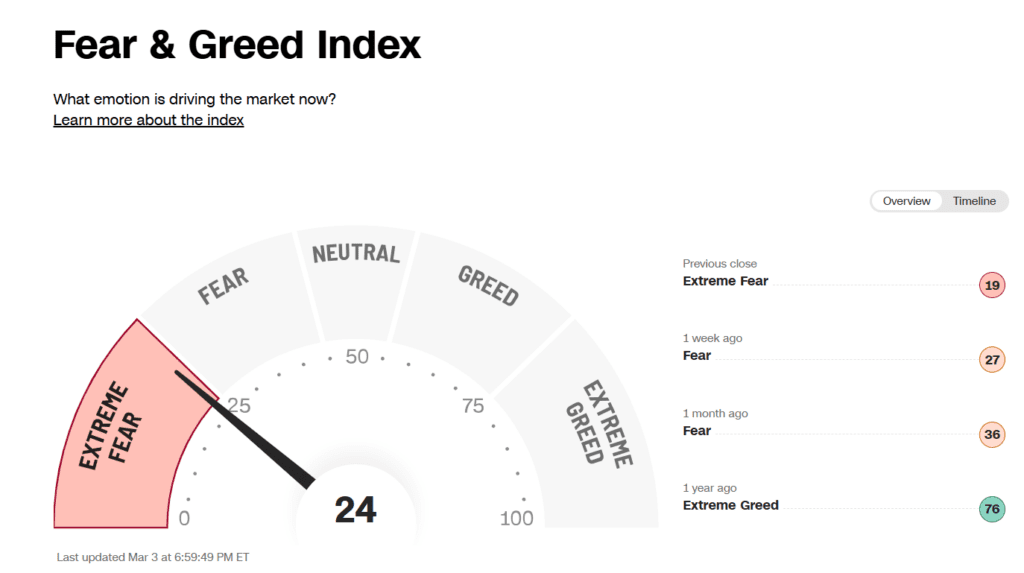

Greed and Fear Index Hits Extreme Fear—Should You Buy or Stay Cautious?

The Greed and Fear Index is flashing extreme fear, and the stock market is feeling the pressure. With Trump’s latest tariff bombshell hitting Canada, Mexico, and China, investors are panicking, and stock prices are dipping.📉 Trump has long maintained that tariffs are a useful tool to correct trade imbalances and protect US manufacturing. He has […]

Why ETF Investing is the Best Strategy for the US Stock Market

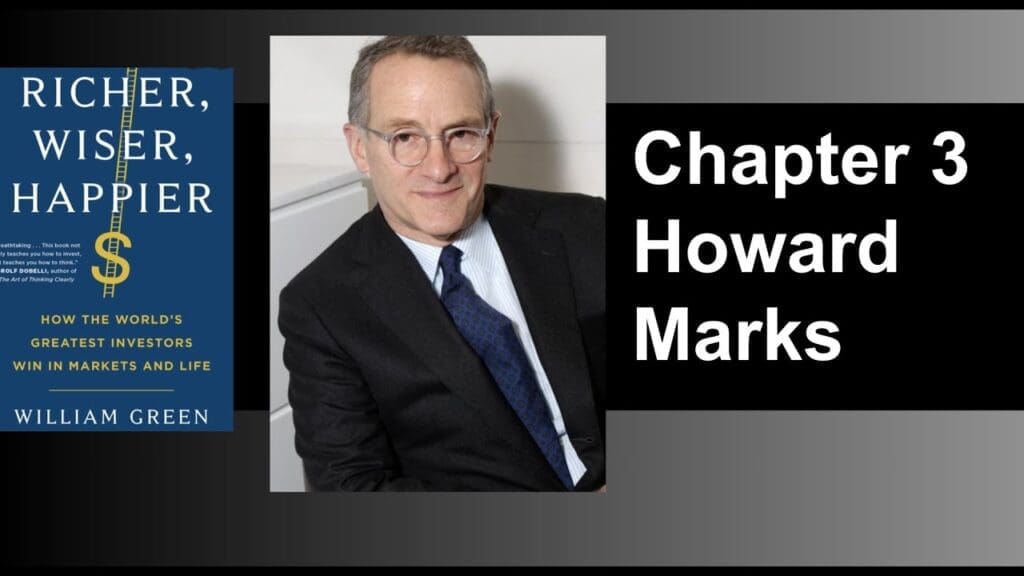

As an investor, I’m always looking for the best ways to grow my wealth safely. Recently, I re-read Richer, Wiser, Happier by William Green for the third time, and it reminded me why ETF investing is one of the best long-term investment strategies for the US stock market. One of the most insightful chapters covers […]

Warren Buffett’s Investment Advice for Women

Last night was truly special, and I just want to take a moment to thank each and every one of you who attended my Money Valentine’s Party! I was overjoyed to see 50 of you turn up for the event, and what touched me the most was the opportunity to empower more women to take […]

How to Invest in Oil and Gas: Warren Buffett’s Strategy & 3 Easy Methods

The oil and gas industry has powered the world for decades, and despite the rise of renewable energy, oil isn’t going away anytime soon. Even Warren Buffett—one of the greatest investors of all time—has poured billions into oil stocks. His big bet on Occidental Petroleum (OXY) tells us that he still sees massive potential in […]

Lessons from Guy Spier’s Book: The Importance of Patience in Investing

Investing is as much about psychology as it is about numbers. This truth hit home for me after reading Guy Spier’s book The Education of a Value Investor. His candid reflections on his own mistakes and vulnerabilities resonated deeply with me, especially as I recalled my own missteps in the market. In this post, I’ll share […]

What I learnt from Guy Spier? (Part 1)

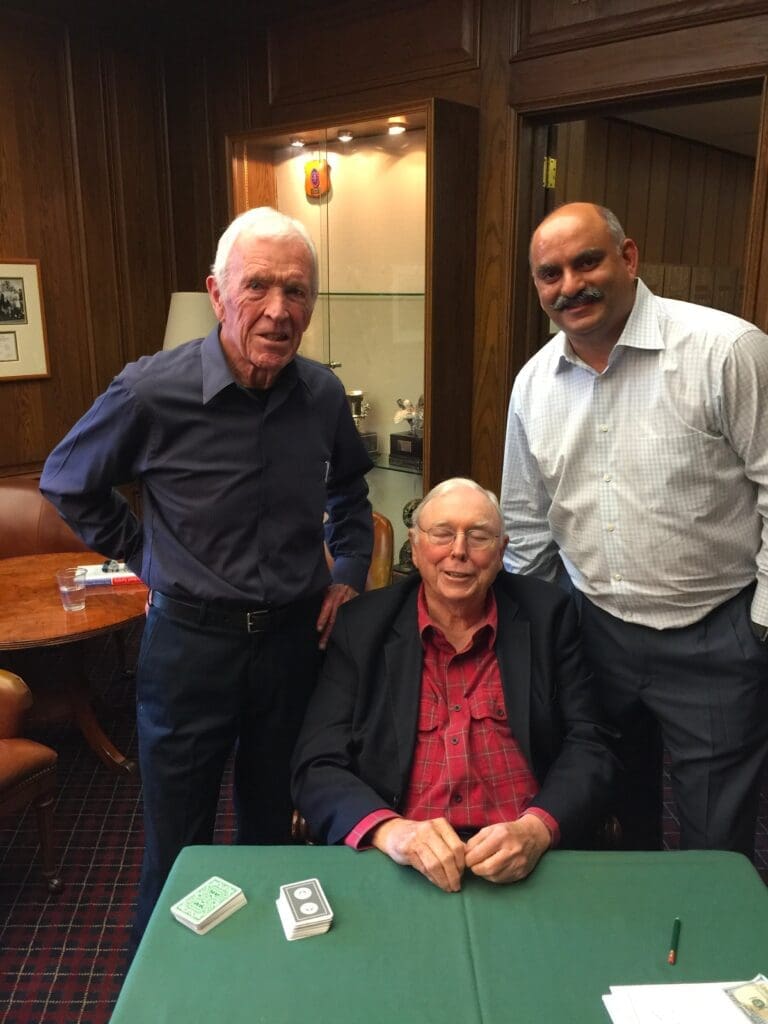

One year ago, I had the honor of interviewing William Green. He shared something profound about the power of kindness—how it can inadvertently lead to success in life. At the time, I didn’t fully grasp it. But recently, while reading Guy Spier’s The Education of a Value Investor, it all clicked. Guy Spier shared a […]

Applying Charlie Munger’s Psychology to Investments – Avoiding Psychological Pitfalls (Part 2)

In Part 1 of this series on Charlie Munger’s investment psychology, we explored 12 psychological tendencies that influence our investment decisions. These insights from Poor Charlie’s Almanack reveal how deeply ingrained biases can subtly guide our actions, often without us realizing it. Understanding these psychological pitfalls helps us make wiser choices that align with long-term […]

Charlie Munger’s Investment Psychology – Understanding the Psychological Biases in Investing Decisions (Part 1)

In the world of investing, few figures inspire as much admiration as Charlie Munger, Warren Buffett’s trusted partner and former vice chairman of Berkshire Hathaway. Munger’s approach to investing goes beyond numbers—he dives deeply into investment psychology to understand how our natural biases influence our decisions, often without us realizing it. In the book, Poor […]