Why ETF Investing is the Best Strategy for the US Stock Market

As an investor, I’m always looking for the best ways to grow my wealth safely. Recently, I re-read Richer, Wiser, Happier by William Green for the third time, and it reminded me why ETF investing is one of the best long-term investment strategies for the US stock market. One of the most insightful chapters covers […]

Why I’m Taking a Sabbatical Leap: Redefining Financial Independence & Fulfillment

For the past year, I’ve been asking myself a life-changing question: 👉 What is truly enough for me? I’ve spent years building my wealth, growing my investments, and achieving financial independence. Yet, despite crossing the $1M net worth milestone, I couldn’t shake the feeling of emptiness and anxiety. I looked around and saw two different […]

Lessons from Guy Spier’s Book: The Importance of Patience in Investing

Investing is as much about psychology as it is about numbers. This truth hit home for me after reading Guy Spier’s book The Education of a Value Investor. His candid reflections on his own mistakes and vulnerabilities resonated deeply with me, especially as I recalled my own missteps in the market. In this post, I’ll share […]

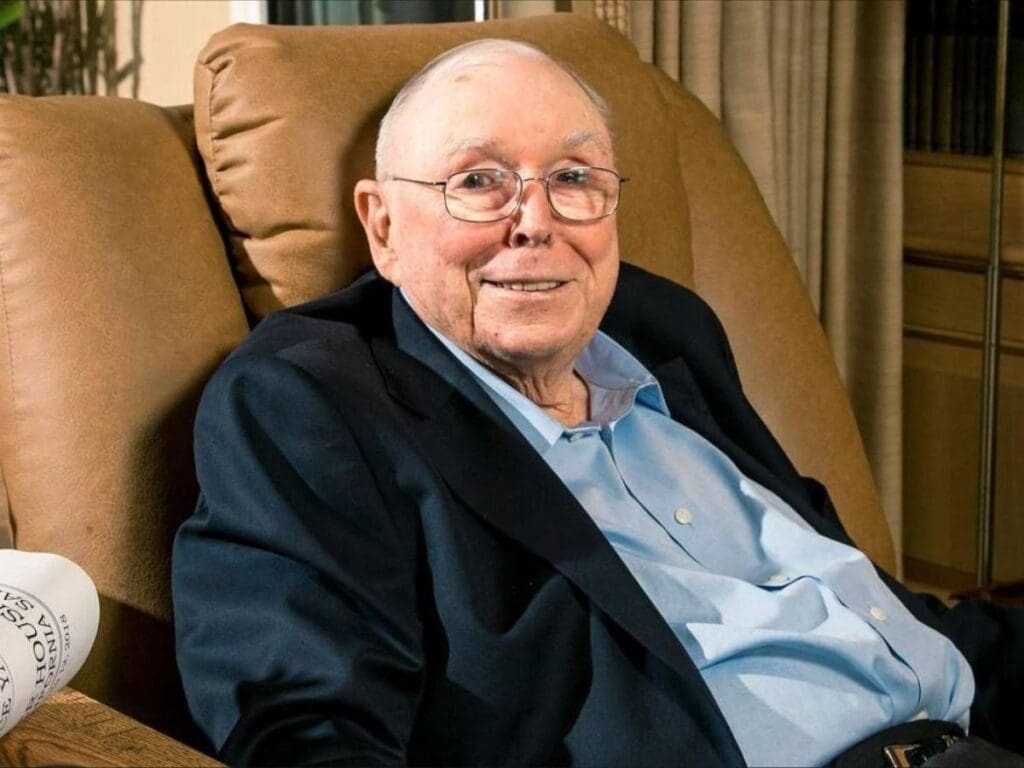

Applying Charlie Munger’s Psychology to Investments – Avoiding Psychological Pitfalls (Part 2)

In Part 1 of this series on Charlie Munger’s investment psychology, we explored 12 psychological tendencies that influence our investment decisions. These insights from Poor Charlie’s Almanack reveal how deeply ingrained biases can subtly guide our actions, often without us realizing it. Understanding these psychological pitfalls helps us make wiser choices that align with long-term […]

Charlie Munger’s Investment Psychology – Understanding the Psychological Biases in Investing Decisions (Part 1)

In the world of investing, few figures inspire as much admiration as Charlie Munger, Warren Buffett’s trusted partner and former vice chairman of Berkshire Hathaway. Munger’s approach to investing goes beyond numbers—he dives deeply into investment psychology to understand how our natural biases influence our decisions, often without us realizing it. In the book, Poor […]

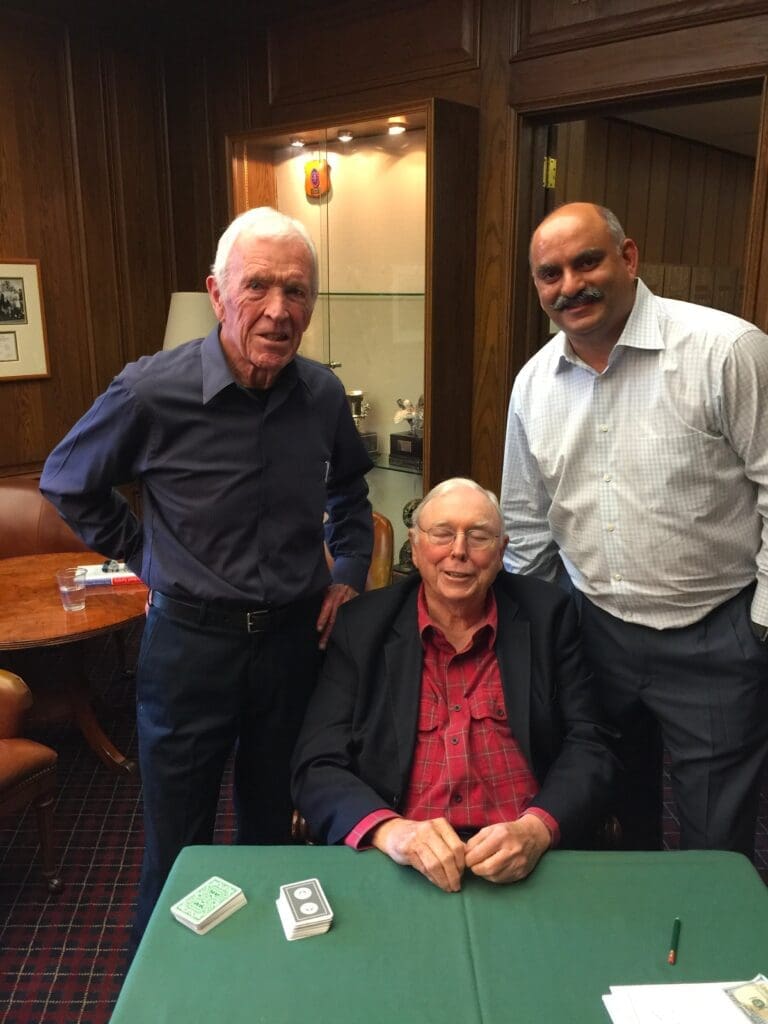

9 Investment Lessons from Fund Manager Matthew Peterson

If you’re looking for timeless investment lessons from fund managers, you’re in the right place. I recently had the incredible opportunity to interview Matthew Peterson, a multi-million dollar fund manager known for his strategic and long-term approach to investing. The insights he shared were invaluable, and I’m excited to bring you the top nine lessons […]

Why did Charlie Munger Give Li Lu $88m?

This morning, I was reading Li Lu‘s book, and I came across a powerful illustration of how trust is built. In Li Lu’s book, he detailedly talked about the encounters with Charlie Munger in his life. He first met Charlie in 1996, but he only managed to have a chance to have a heartfelt talk with […]

What I learnt from Mohnish Pabrai: The Warren Buffett of India

With Berkshire Hathaway AGM coming to an end, I felt so fortunate to be able to learn and meet from so many brilliant investors all over the world. They’ve showered us with immense wisdom and kindness, helping us on our journeys to becoming better investors. I will be writing a series of reflections along the […]

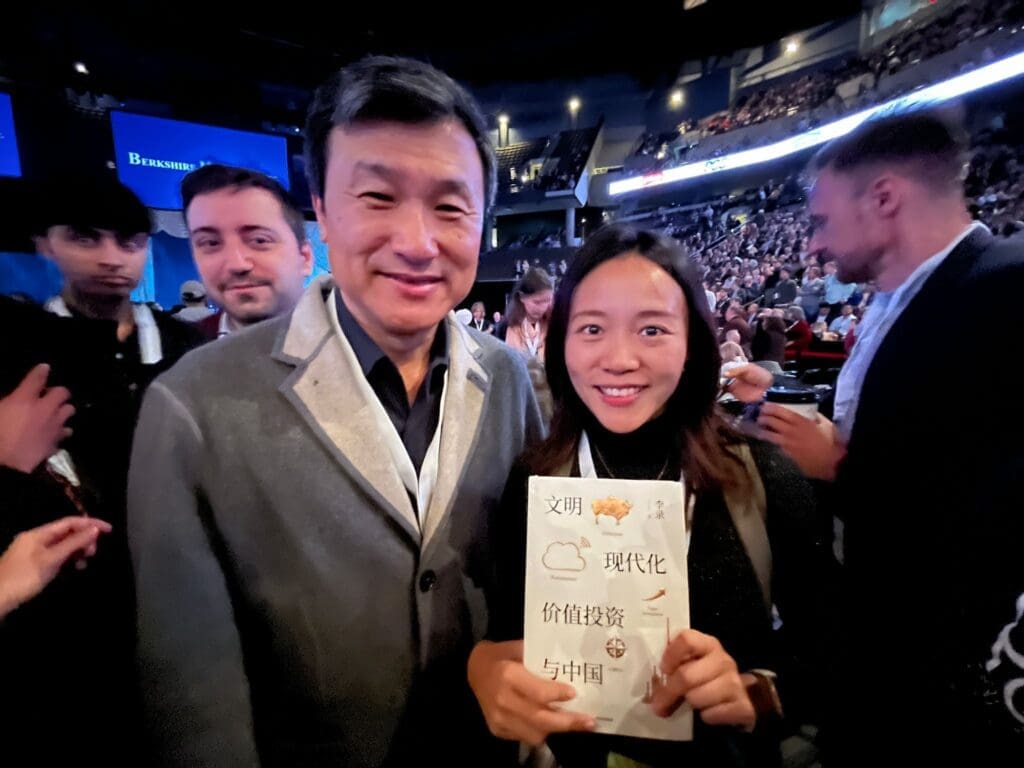

What I learnt from Li Lu: The Warren Buffett of China

During my recent trip to the Berkshire Hathaway AGM, I had the honor of meeting Li Lu in person. When I saw him in the hall, he was already surrounded by a crowd eager to learn from the “Warren Buffett of China” by asking him questions. Humility is the one word that best describes Li […]

What I learnt from Ken Honda

I recently interviewed Japanese bestselling author Ken Honda, whose books have sold close to 9 million copies worldwide. During our chat, he revealed his secret to financial peace. And his answer was extremely shocking to me. Friends. “If I ever hit rock bottom,” Ken Honda explained, “I have over 50 friends who’d gladly offer a […]

7 lessons I’ve learned from Charlie Munger

As I’m re-reading the chapter about Charlie Munger inside “Richer, Wiser, Happier” by William Green, I can’t help but feel in awe of how much I can learn from this legend by studying his words again. Here’s the summary of the 7 lessons I’ve learned from Charlie Munger. **1. Be Humble and Avoid Being Foolish** […]

Investing Wisdom from Vitaliy Katsenelson — Soul In The Game

In the last few years, I’ve grown increasingly fond of reading books that contain investors’ life lessons, from William Green‘s Richer, Wiser, Happier to Gautam Baid‘s The Joys of Compounding. I’m so glad I grabbed the opportunity to buy fund manager Vitaliy Katsenelson’s newest book, Soul in the Game, while in Omaha. Although the book […]

What Would Adam Khoo Tell His Dying Self?

What Would Adam Khoo Tell His Dying Self? They’ll Surprise You Imagine today is your last. You’ve lived a full life, achieved everything you set out to do, but all your published works – books, videos, articles – vanish with you. You can only leave the world with three pieces of advice. What would they […]

30 Mins with Robert Kiyosaki (Rich Dad Poor Dad) on Millionaire Mindset

30 Mins with Robert Kiyosaki (Rich Dad Poor Dad) on Millionaire Mindset Billion Dollar Lesson from Robert Kiyosaki Financial guru Robert Kiyosaki, author of the mega-hit “Rich Dad Poor Dad,” isn’t afraid to challenge the status quo. I recently had the opportunity to sit down with him, and his insights on financial education, entrepreneurship, and […]

Gautam Baid’s Secrets To Millions

April 13, 2024 Elementor #10706 5 Millionaire Habits Anyone Can Start Today With Gautam Baid Recently, I had the honor of interviewing Gautam Baid, bestselling author of “The Joys of Compounding” and managing partner of Stellar Wealth Partners India Fund, which achieved a stunning 42% return in 17 months. While he shared a wealth of […]

William Green Interview

April 8, 2024 William Green Interview William Green On What It Takes To Have A Richer Wiser Happier Life It felt like a dream come true when I landed this interview with William Green. I’ve been a long-time fan of his work, especially his international bestseller, Richer, Wiser, Happier. The book has had a profound […]

Why Opportunity Cost Could Be Killing Your Portfolio

Opportunity Cost Could Be Killing Your Portfolio… I know it sounds very serious. But it’s true. Here’s why! When it comes to life and investing, I used to eagerly chase every opportunity that came my way, driven by FOMO (fear of missing out) and an unwillingness to let go. However, the truth is, our daily […]

Why I think Sea Limited Is Doomed

This morning, I was engrossed in reading “The Buffettology Workbook” by my investment mentor, Mary Buffett. Interestingly, her insights seem to resonate with what’s unfolding at Sea Limited. According to Mary, Warren Buffett typically avoids investing in commodity type of business businesses. But how can you identify one? Mary’s take on this is quite intuitive: […]

Cash is King?

“Cash is king.” We have heard of this saying a long time ago and are often advised by our parents or families to keep more cash. However as an investor, I used to hate keeping cash because holding cash in the bank yields a meaningless return. But after experiencing the recent market cycle, I grew […]

Japan Stocks At A Glance – Is It Cheap To Buy Now?

Japan stocks have surged by over 25% this year, surpassing the 17% gain in the US stock market. Does the recent investment by Warren Buffett indicate that it is time to consider Japanese stocks? When it comes to Japanese stocks, many investors immediately think of Sony and Softbank. In this article, let’s take a quick […]

Palantir Stock Price – Is It Time To Buy?

Palantir stock price has increased over 180% this year. Is it still the right time to buy? Palantir’s sales for the second quarter clocked in at $533 million, up 13% year over year. Billings expanded 52% year over year to $603 million. This strong expansion could be due to the increased interest in Palantir’s products […]

Alibaba Split – Is This A Time To Buy?

Alibaba split is happening soon. The company plans to split into six business groups, each having the option to raise funding from outside and go public. Here’s why you should closely consider investing in Baba. Brilliant investors like Joel Greenblatt, Peter Lynch, and Gautam Baid have highlighted the advantages of spin-offs. Joel Greenblatt explained in […]

Microsoft VS Google, Which Should You Buy?

Microsoft VS Google, which is better? Shares of Microsoft went up by 5.3% today, reaching a new all-time high. This is the first time it has reached such a high level since late 2021. It’s not surprising that Microsoft’s stock is rising because they made some exciting AI announcements. Microsoft VS Google – Why Microsoft? […]

TSM Stock Update

While Nvidia may currently be in the spotlight for its advancements in artificial intelligence (AI), astute investors should not overlook TSM stock (Taiwan Semiconductor Manufacturing). Here’s why… The surge in Nvidia’s stock has caused a ripple effect, boosting chip stocks globally. The reason behind this is quite simple: Nvidia doesn’t manufacture its own chips. Instead, […]

My greatest investment mistake and what I learnt from it

This morning, as I was reading the book “The Joys of Compounding” by Gautam Baid, it reminded me of a very painful investment mistake that I made, which cost me over $50,000. It also shared with me how I can prevent this from ever happening again. I stepped into the investment world wanting to make […]

Time to buy Tesla stock?

Tesla’s recent update on production and delivery reveals that the company is going strong. They manufactured nearly 480,000 electric vehicles (EVs) in the second quarter, with deliveries soaring 83% higher compared to the previous year. The good news propelled the stock price higher and Tesla’s stock has more than doubled this year! Is it time […]

Berkshire Hathaway — Why You Should Buy This Stock?

Many people often mistake Berkshire Hathaway for an investment holding company. They think that by buying Berkshire Hathaway stock, they are simply acquiring Warren Buffett‘s holdings in Apple, Bank of America, Amex, Coca-Cola, and 50 other publicly listed companies. However, that is not true because Berkshire is much more than that. Berkshire Hathaway is a […]

Analyse Any Stock In 1 Min With This AI Investing Tool

Have you ever found yourself spending hours digging through financial information about a company, only to still feel clueless about how to analyze that data? I completely understand! The vast amount of information available and the complexity of reading financial reports can be overwhelming, making it challenging for many investors to get started. If you’re […]

Warren Buffett and Charlie Munger Fought Over This

In the recent Berkshire AGM, one investor asked the two wise gentlemen about the future of value investing. Interestingly, both of them disagree with each other. Charlie Munger, Berkshire Hathaway vice-chairman and Buffett’s long-time right-hand man, has a more pessimistic view on value investing. “I think value investors are going to have a harder time […]

Unveiling the Winning Formula: Matthew Peterson’s Decade of Beating the Market

I had a wonderful interview last night with Matthew Peterson from Peterson Capital Management, and the entire session was simply mind-blowing! Matthew revealed a plethora of investment insights on how he managed to achieve a compounded annual growth rate of over 14% for his fund over the past 11 years. Here are my key personal […]

Top 10 Investing Tools 2023

Are you a beginner looking to start investing but don’t know where to begin? Look no further, because in this post, I’m going to cover the top 10 investing tools 2023 that will help you take control of your finances and start investing like a pro. Top 10 Investing Tools 2023 No.1 — Chat GPT […]

Time To Sell Baba?

Alibaba’s stock price has suffered significantly in recent years, resulting in a painful 50% loss for shareholders who have held the stock for the past five years. Additionally, investors were shocked by the negative earnings the company is suffering from. These losses have led many to question whether Alibaba has lost its competitive edge. Is […]

Why did Warren Buffett Sell TSMC?

Warren Buffett slashed his holding of Taiwan Semiconductor Manufacturing Co (TSM) by as much as 86%, just months after disclosing a $4 billion stake. Why did Warren Buffett sell TSMC? After the massive selling, TSM will only occupy about 0.21% of Berkshire’s holding. This unusual quick reversal by Warren Buffett caused TSM’s share price to […]

7 Ways To Make Passive Income

The economic situation seems to be a lot more challenging in 2023. You are wondering how to make more passive income so you can provide more for yourself and your family amid this rising inflation. Additional a few thousand dollars in passive income every single month, is that even possible? It’s totally possible and this […]

Why Tesla Drop?

Tesla reported its latest earnings, beating on both earnings and revenue. CEO Elon Musk said the company might be able to produce 2 million cars this year. Investors love the good news, and Tesla stocks went up over 30% in the past 1 week. However, compared to its all-time high just about a year ago, […]

Are Amazon Stocks Good or Bad?

Amazon has been having negative free cash flow for the past 4 quarters. Is this a sign of the company weakening? Are Amazon stocks good or bad right now? At first glance, it may seem worrying to see Amazon “losing money”. Its free cash flow was down 871% YOY in Q3 2022. But a deeper […]

Can you retire with a million dollars? Step-by-step guide

Many of us want to retire as millionaires, so we don’t have to worry about money and still live a comfortable retirement life. The question is, can you retire with a million dollars? And how to amass a million dollars or more by retirement, given the years you have before you retire. If you have read my previous […]

Options Hedge Strategies

With the market jumping due to the recent inflation cool-down, many investors are expecting the FED to pivot. But what if it doesn’t happen? Could this potentially lead us to another market crash? Learn options hedge strategies to protect your portfolio against the potential market crash! The FED will only be making announcements on their […]

Safe to buy call options now?

If you have attended our 3-day Options Mastery Bootcamp before, you’ll know the power of buy call options (Strategy X) and how it can help you to get exponential returns during a bull run. And I know it must be very tempting to do so right now. Because if you get the buying timing right, […]

Selling Call Options

You have 100 shares of Tesla and you believe that long-term the stock price will go up, but lately, the stock market is behaving like a see-saw, up down up down, and going nowhere. You are wondering, how can you generate additional potential income while holding onto the Tesla stocks. If you want to generate […]

Dip Buyer Profit Strategy

The market has been really volatile lately. How to profit as a dip buyer? Let’s imagine: you want to buy 100 shares of Google at $110 but right now the price is too high, what should you do? Most investors will just keep on waiting for the price to fall, but do you know that […]

What are options call

What are options call and how you can use them to profit safely in this volatile market? In this post, let’s begin by understanding what is options call, and how you can use them safely and effectively, so you can start realizing what options trading strategies really work. Options trading is really simple. It’s basically trading […]

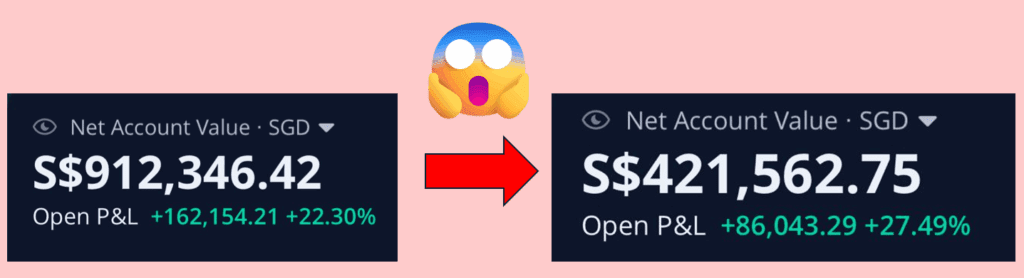

My $500,000 Disappeared Overnight… What Happened?

My Webull account went from over $900,000 to only $400,000 left. WHAT HAPPENED? Before you panic—don’t worry, I didn’t blow up my portfolio with risky trades. In fact, my portfolio has been growing stronger than ever with my ETF and options strategy. But when I logged in the other day… Simple—I transferred over $400,000 worth […]

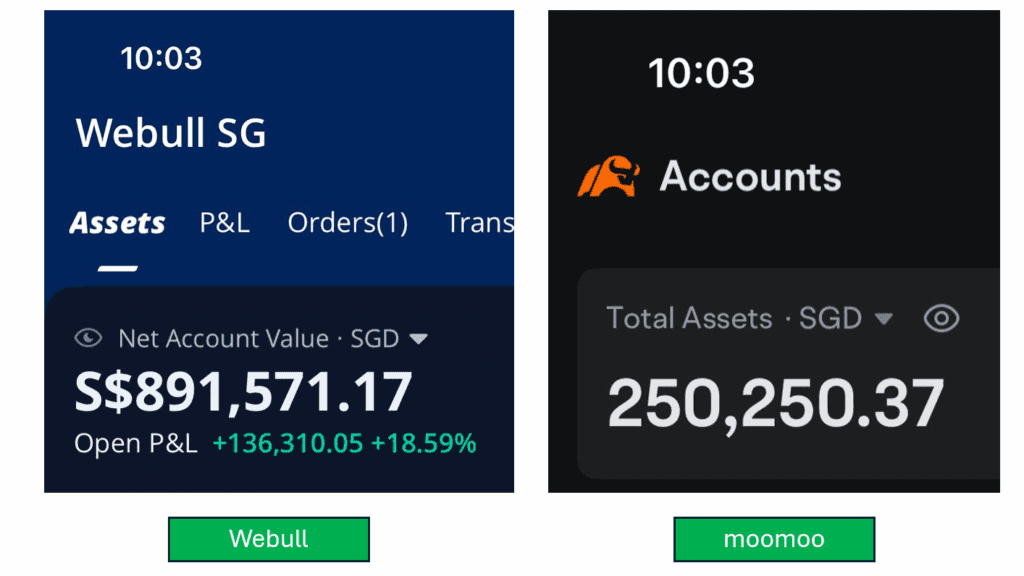

I’m Thinking of Investing $100K Into This Brokerage—Here’s Why

Yes, you read that right. Even though I already have close to $900K SGD in Webull and another $250K+ SGD in Moomoo, investing in stocks and options. I’m now seriously considering parking another six-figure sum into a third brokerage account. Why? Because I recently came across Longbridge Singapore, and their rewards and platform benefits are […]

A story I’ve never told fully…

When I was younger, my grandmother used to water down soap just to make it last a bit longer. She reused every plastic bag, saved every coin, and made frugality a way of life. That mindset shaped me deeply.Even when I started working, I avoided luxury items, rarely dined out, and saved as much as […]

The Most Expensive Decision of My Life

This is the most expensive program I’ve ever signed up for in my life. Over $15,000 SGD — for just five days at Making the Stage. Before the training, I kept wondering:Am I crazy?Did I just make a huge mistake?Is this really worth it? I couldn’t shake the doubt. What if I walked away with […]

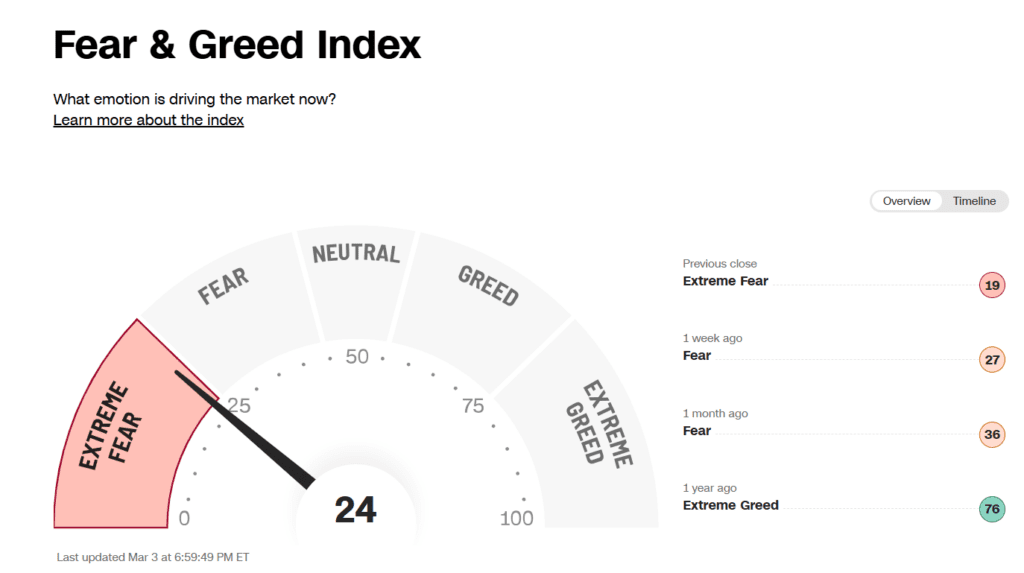

Greed and Fear Index Hits Extreme Fear—Should You Buy or Stay Cautious?

The Greed and Fear Index is flashing extreme fear, and the stock market is feeling the pressure. With Trump’s latest tariff bombshell hitting Canada, Mexico, and China, investors are panicking, and stock prices are dipping.📉 Trump has long maintained that tariffs are a useful tool to correct trade imbalances and protect US manufacturing. He has […]

Taking a Sabbatical: Why I’m Embracing the Unknown and You Should Too

It’s been a week since I made the decision to take a six-month sabbatical in Canada later this year. Many of you have reached out to congratulate me, calling me courageous for taking this leap. But if I’m being completely honest, I feel a mix of excitement and fear. Because making this decision also means […]

Warren Buffett’s Investment Advice for Women

Last night was truly special, and I just want to take a moment to thank each and every one of you who attended my Money Valentine’s Party! I was overjoyed to see 50 of you turn up for the event, and what touched me the most was the opportunity to empower more women to take […]

How to Invest in Oil and Gas: Warren Buffett’s Strategy & 3 Easy Methods

The oil and gas industry has powered the world for decades, and despite the rise of renewable energy, oil isn’t going away anytime soon. Even Warren Buffett—one of the greatest investors of all time—has poured billions into oil stocks. His big bet on Occidental Petroleum (OXY) tells us that he still sees massive potential in […]