What are options call and how you can use them to profit safely in this volatile market? In this post, let’s begin by understanding what is options call, and how you can use them safely and effectively, so you can start realizing what options trading strategies really work.

Options trading is really simple. It’s basically trading financial contracts. In the stock market, there are buyers and sellers of stocks. In the options market, there are buyers and sellers of contracts. But why do people want to buy and sell options contracts? How can they make money out of it? Let’s first understand what are options.

Options are financial contracts that give investors the right or obligation to buy or sell a stock at an agreed-upon price and date. There are only 2 types of options you need to learn. The first one is options CALL, and the other is options PUT.

But I know you must be wondering, why is it so confusing and there are so many things happening in just 1 sentence? That’s why in this post, I’m going to explain to your step-by-step, what options CALL is first. If you like this post and want me to do another post on PUT options, you just simply comment “put options” below!

What exactly options CALL is?

Let’s use a very layman and easy-to-understand investing instrument, called property, to explain the concept of call options! Imagine you spotted a really nice property in the downtown area. It’s very new and next to the train station, and you know that given time, this property is going to increase in price. That’s why you want to buy this property right now, so you can profit in the future!

However, in order to buy this property, the owner is asking for $1m cash. And when you check your bank account, you realise you don’t have this huge amount of money inside! (Seriously, who will wanna put $1m in the bank and do nothing nowadays, unless you are either Crazy Rich Asian or just Crazy Asian)

But being a smart investor, you are not going to give this opportunity a miss. That’s why you decided to strike a deal with the owner, and ask him to write you a contract.

Options Call Property Role-play

You: “I am really serious to buy the property at $1m cash from you. But I need some time to get those cash. How about this, I will give you $50,000 right now to buy a contract from you. And this contract will enable me to come back and buy your property at the current price of $1m in the next 2 years. So you will get to make $1m and $50k in total!”

Owner: “Hmm sounds like a good deal. I wanted to sell the property at $1m anyway, and on top of that, I get to earn an additional $50,000 immediately. Sure let’s do it!”

And tada! Both of you shake hands and transacted the deal!

Now fast forward 1.5 years later, the property price continues to increase, and right now, the original $1m property, is now worth $2m in the market. What will you do right with this contract that you bought previously?

Options Call Property Role-play (1.5 Years Later)

You: “Hey remember me? 1.5 years ago, I bought this contract from you with $50,000 to lock in the property buy price at $1m. Right now although the market price has gone up to $2m, I will still be able to buy from you at $1m. So here’s my million-dollar cash!”

Owner: “Oh no! You got the contract in your hand! I have no choice but to sell you my property at $1m. You made $1m just like this!”

Hurray!! Let’s celebrate!!

You just made a 100% return!

But wait, some of you may be wondering, what if you still don’t have that $1m cash, does it mean that you are going to forfeit the opportunity?

The answer is NO~~~~

Because right now, your contract is now worth a lot of money.

Options Call Flipping Strategy

Anyone with this contract can buy the property at $1m, while the market is selling it at $2m.

So this contract is now worth $1m. And you can sell away this contract to someone else to profit tremendously!

And think about it. You invested $50000 to buy this contract, and now when you sell it away, you can sell at $1m. Your return on investment is close to a whopping 2000%!!

This strategy is called flipping the property, by buying and selling the Options to Purchase contract. And this was exactly how people used to profit in the past! However, with rules and regulations coming into the property market and the crazy amount of tax, we can no longer do that. But you can still do this options strategy every day in the options market, by simply being a options call buyer!

When you buy a call, you are literally buying the right to buy the stocks at the agreed lock-in price within a certain period of time. And when the stock price goes up, your call options contract is going to be worth a lot of money, just like what happened to the property example just now!

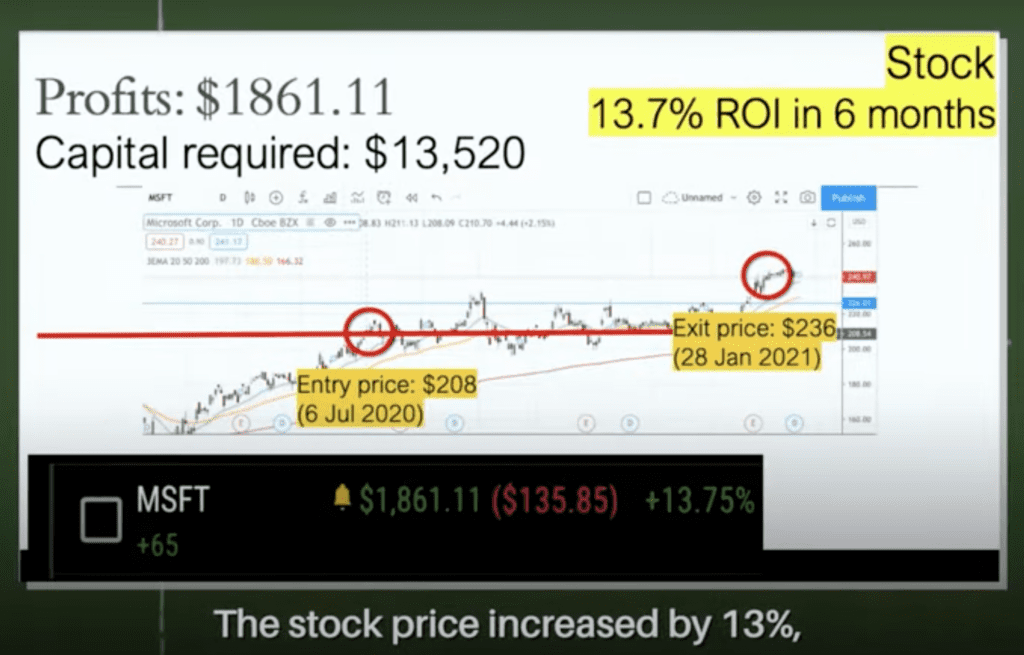

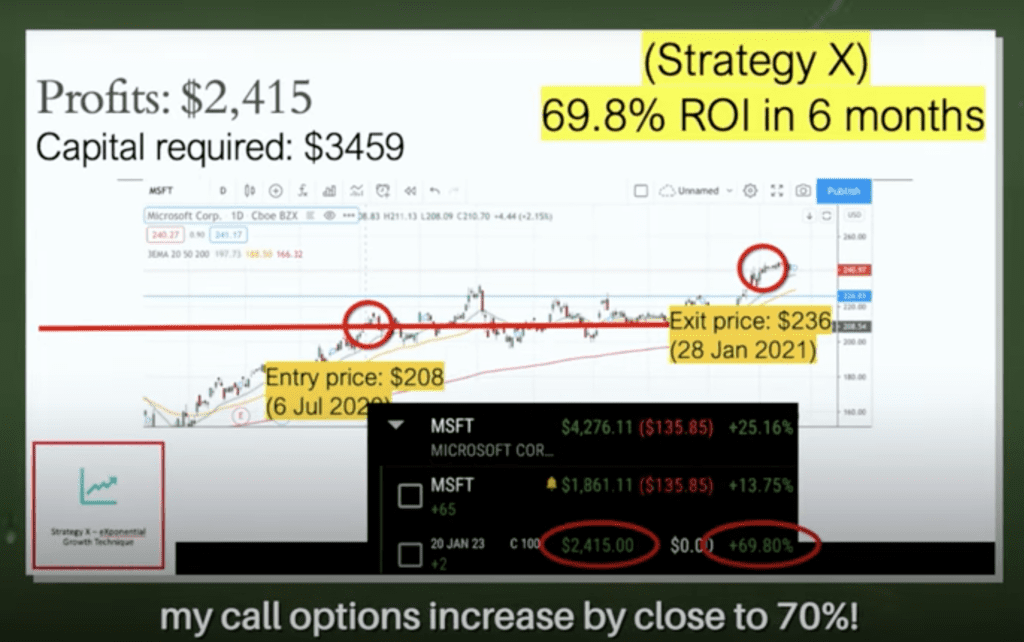

This is exactly what I did for one of my options trades on Microsoft. The stock price increased by 13%, while my call options increase by close to 70%!

Risk of Options Call?

But you must be wondering, what is the risk to buying call options? The risk lies in if you invest in lousy companies that do not go up in prices, your call options will become more and more worthless over time. And even if the stock doesn’t go to 0, your call options value can go to 0, if you don’t know what you are doing. That’s why it’s so important to get yourself educated before starting your investment journey!

But if you know how to do it right using call options, you can accelerate your portfolio growth tremendously during the market upturn, just like how one of our students Hadi turned his portfolio from 200k to more than $1m in a short 7 months during the covid V-shape recovery!

If you want to learn how to invest in options step-by-step, do join us in our upcoming options foundation class, where we are going to share with you 3 options strategies to profit regardless of the market conditions. All you need to do is to click here to sign up for your free spot!

Lastly do remember to join my Telegram Channel to follow more investment insights every day! I also wrote a post on how to invest your first $10,000 to help you get started on your investing journey safely. Do check it out to keep your learning going!

Happy investing and I will see you in the next sharing! Arigato! 🙂

P.S. I also made a YouTube video on options call strategy. Check it out and hope you find it useful too!