The oil and gas industry has powered the world for decades, and despite the rise of renewable energy, oil isn’t going away anytime soon. Even Warren Buffett—one of the greatest investors of all time—has poured billions into oil stocks. His big bet on Occidental Petroleum (OXY) tells us that he still sees massive potential in this sector.

So, is oil still worth investing in? And how can you get started? Let’s break it all down.

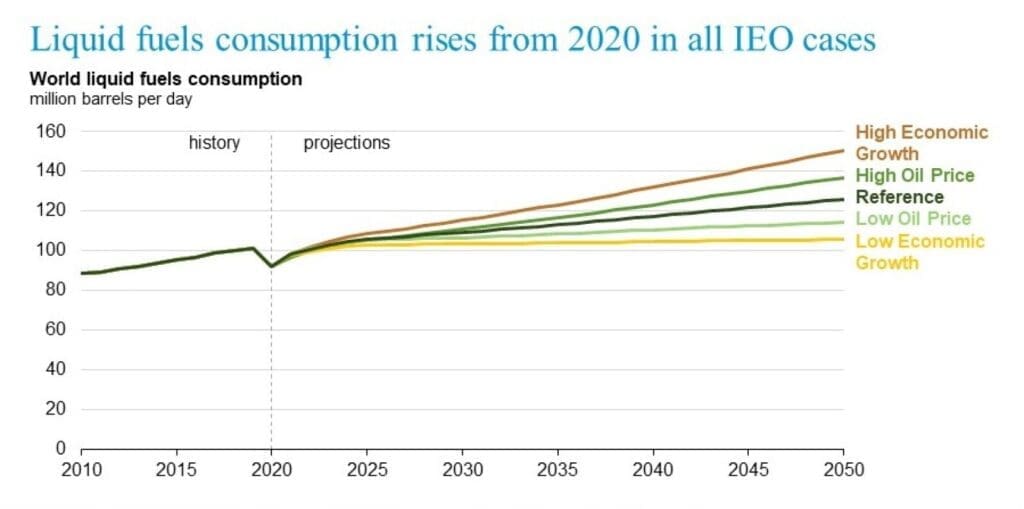

Will Oil Demand Drop? Here’s What Experts Say

- The International Energy Agency (IEA) predicts global oil demand will remain strong until at least 2040.

- Countries like China and India are using more oil than ever, keeping demand high.

- The world still needs 110 million barrels per day, and that won’t change overnight!

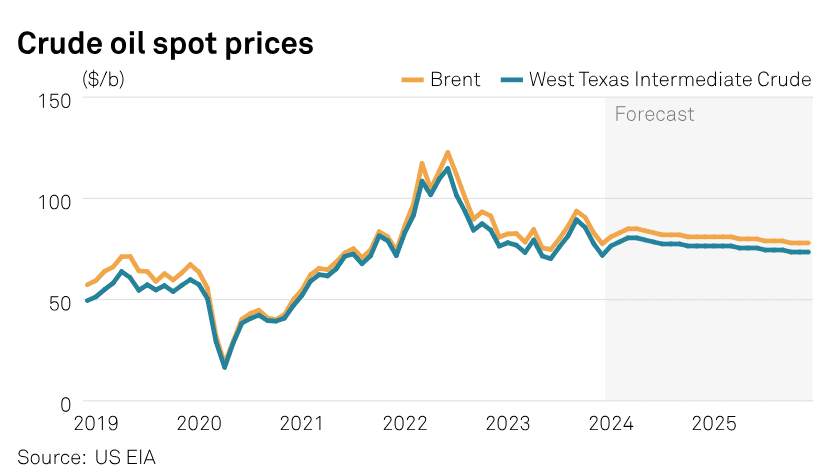

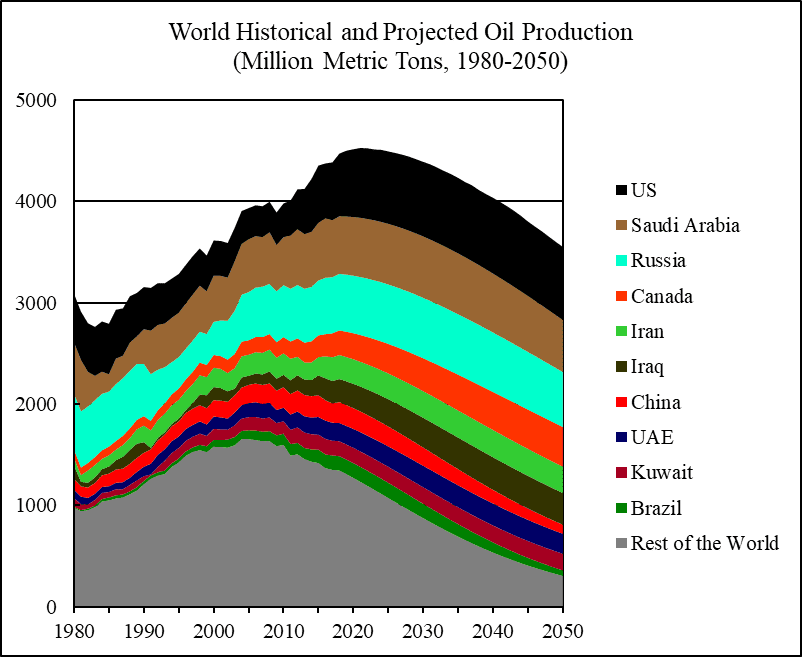

How High Will Oil Prices Go in 2024 and Beyond?

- Some experts predict oil could hit $100 per barrel again due to supply issues.

- U.S. shale oil production is slowing, meaning OPEC+ (the group of major oil-producing countries) will control prices even more.

Oil Companies Are Evolving

- Many big oil companies are investing in carbon capture technology to offset emissions.

- Hybrid energy companies are emerging, combining fossil fuels with renewables to stay relevant.

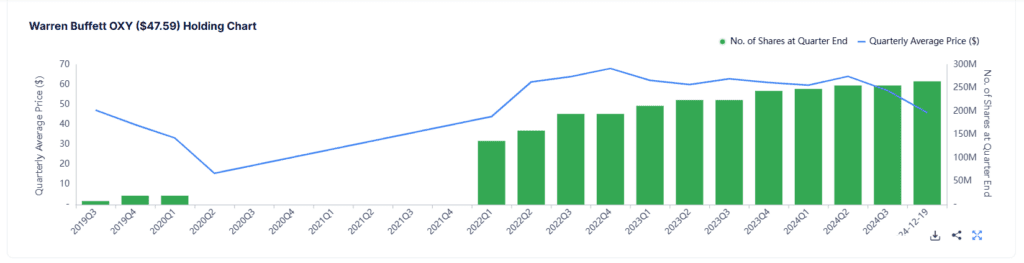

Warren Buffett’s Billion-Dollar Oil Investment: What We Can Learn

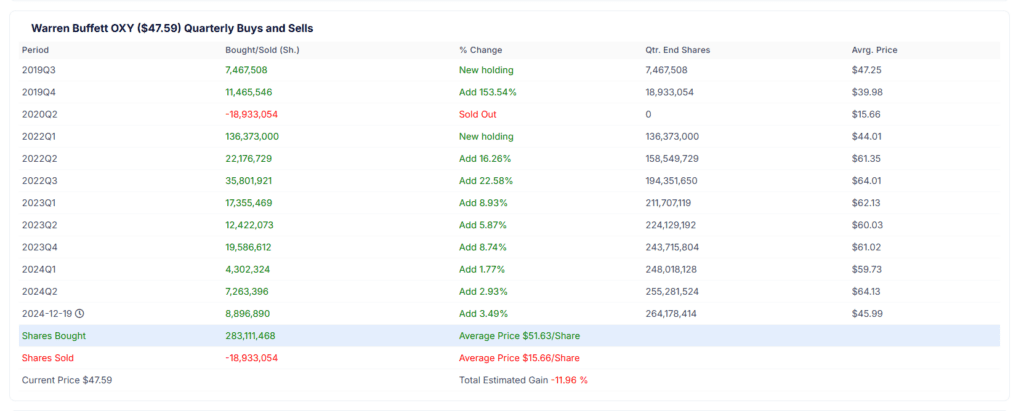

Warren Buffett isn’t known for risky bets. When he buys big, it’s because he sees long-term value. His investment in Occidental Petroleum (OXY) through his company Berkshire Hathaway shows us that oil can still be a money-maker if you invest long-term.

Why Buffett Chose Occidental Petroleum (OXY)

✅ Cash Flow Machine – OXY generates high cash flow and is paying down debt fast.

✅ Inflation Hedge – Oil prices tend to rise with inflation, making it a solid investment.

✅ Smart Energy Play – OXY is investing in carbon capture, positioning itself for the future.

Do note that right now the share price of OXY is lower than Warren Buffett‘s average pruchase price. If Warren Buffett believes in oil’s future, it might be worth considering energy stocks for your portfolio too!

3 Ways to Invest in Oil and Gas (With Pros & Cons)

Want to invest in oil but not sure where to start? Here are three simple ways to get involved:

1. Buying Oil Stocks (Best for Long-Term Growth)

Investing in oil and gas stocks gives you direct exposure to the industry. These companies fall into three categories:

- Exploration & Production (E&P): Companies that drill and extract oil (Occidental, ExxonMobil, Chevron).

- Midstream: Companies that transport and store oil (Enbridge, Kinder Morgan).

- Downstream: Companies that refine and sell fuel (Valero, Marathon Petroleum).

Why Invest in Oil Stocks?

✅ Potential for Big Returns – Stocks rise when oil demand increases.

✅ Dividend Payouts – Many oil companies provide steady dividends.

✅ Inflation Protection – Energy prices rise with inflation.

⚠️ Risks:

❌ Oil prices fluctuate a lot, so stocks can be volatile.

❌ Government regulations may impact oil company profits.

❌ Geopolitical events can affect supply and prices.

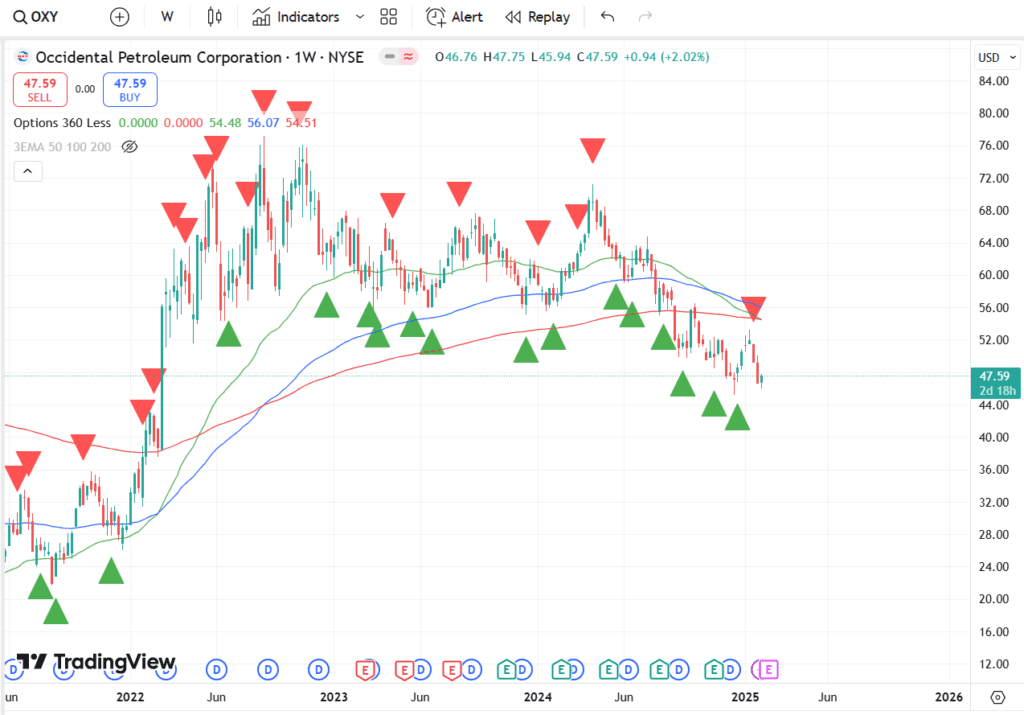

However, based on the options 360 technical analysis indicator, OXY looks like on a downtrend with the Red Arrow recently appeared. So this won’t be ideal for short-term bullish trades.

2. Investing in Oil and Gas ETFs (Lower Risk & More Stability)

If picking individual stocks feels risky, oil and gas ETFs (Exchange-Traded Funds) provide diversification. I personally love incorporating ETFs with options strategies to increase my returns, and I share much more in-depth insights in my Options to Freedom masterclass. Feel free to check it out!

Top Oil & Gas ETFs:

- XLE – Holds energy giants like Exxon and Chevron.

- IEO – Focuses on companies involved in oil drilling and production.

- OIH – Invests in oilfield service companies (like drilling equipment providers).

Why Invest in Oil ETFs?

✅ Diversification – Lower risk than buying a single stock.

✅ Less Work – No need to track individual companies.

✅ Easy to Buy & Sell – ETFs trade like stocks.

⚠️ Risks:

❌ ETFs still depend on oil prices, so they can fall in a downturn and oil prices are very cyclical in nature.

❌ Some ETFs charge management fees that reduce profits.

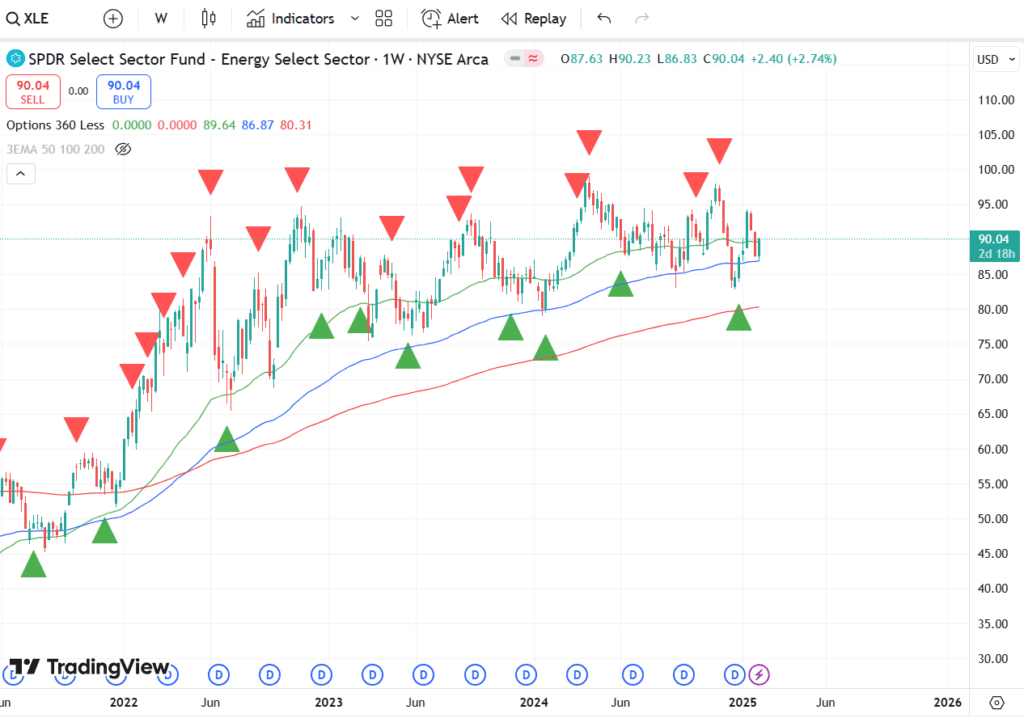

Based on the options 360 technical analysis indicator, XLE looks more like promising for short-term bullish trades with the Green Arrow recently appeared.

3. Investing in Private Oil and Gas Deals (High Risk, High Reward)

For those looking for higher potential returns, private oil deals can be an option. These include:

- Drilling Partnerships – Investing directly in oil drilling projects.

- Royalty Interests – Earning a percentage of profits from oil wells.

- Private Energy Funds – Investing in private companies managing energy assets.

Why Consider Private Oil Investments?

✅ Higher Potential Returns – If successful, these investments can generate big profits.

✅ Less Market Volatility – Private investments don’t move with the stock market.

✅ Ownership in Real Assets – Gain a stake in real oil production.

⚠️ Risks:

❌ High Risk – Some projects fail, leading to losses.

❌ Long-Term Commitment – Private deals are not easily sold.

❌ Regulations Can Change – Government policies can impact profitability.

Final Thoughts: Which Oil Investment is Right for You?

| Investment Type | Best For | Key Benefit | Key Risk |

|---|---|---|---|

| Oil Stocks | Active Investors | Potential for big profits | Price volatility |

| Oil ETFs | Passive Investors | Easy diversification | Oil market fluctuations |

| Private Deals | High-risk investors | Higher potential returns | Liquidity & regulatory risks |

If you want a safe way to invest, oil stocks and ETFs are a great place to start. But if you’re open to higher risks for bigger potential gains, private oil investments might be worth considering.

Either way, oil and gas remain major players in the global economy, and investing in this sector can be a great way to grow your portfolio.

What’s Your Take?

Are you investing in oil and gas? Do you prefer stocks, ETFs, or private deals? Leave your thoughts in the comment below and let me know!

I personally love incorporating ETFs with options strategies to increase my returns, and I share much more in-depth insights in my Options to Freedom masterclass. Feel free to check it out too!

Arigato! 🙌

Chloe