Investing is as much about psychology as it is about numbers. This truth hit home for me after reading Guy Spier’s book The Education of a Value Investor. His candid reflections on his own mistakes and vulnerabilities resonated deeply with me, especially as I recalled my own missteps in the market.

In this post, I’ll share my key takeaways from Spier’s book, particularly the importance of patience in investing, and how my own experiences—like selling Meta shares at the bottom—taught me invaluable lessons about emotional discipline and long-term thinking.

My Costly Mistake: Selling Meta at the Bottom

A few years ago, I made a decision that still stings: I sold my Meta (formerly Facebook) shares at the bottom. At the time, I was leveraging my brokerage account, chasing quick gains, and trying to accelerate my path to financial success. But when the market turned against me, I panicked. The stress of using margin, combined with the fear of losing more, overwhelmed me. In that moment of emotional turmoil, I sold a significant portion of my Meta holdings—a decision that, in hindsight, was driven by fear rather than rationality.

This experience taught me a hard lesson: impatience in investing can be costly. Reading Guy Spier’s book reinforced this idea, as he openly shares his own mistakes and emphasizes the importance of emotional discipline.

The Story of Rick Guerin: A Lesson in Patience

One story from Spier’s book that particularly stood out was the tale of Rick Guerin, a gifted investor and friend of Warren Buffett. During the market downturn of 1973-74, Guerin was forced to sell his holdings, including thousands of shares of Berkshire Hathaway—shares that would now be worth a fortune.

Buffett later reflected on this, saying, “Charlie and I always knew we would become very wealthy, but we weren’t in a hurry.” He added, “If you’re even a slightly above-average investor who spends less than you earn, over a lifetime you cannot help but get very wealthy—if you are patient.”

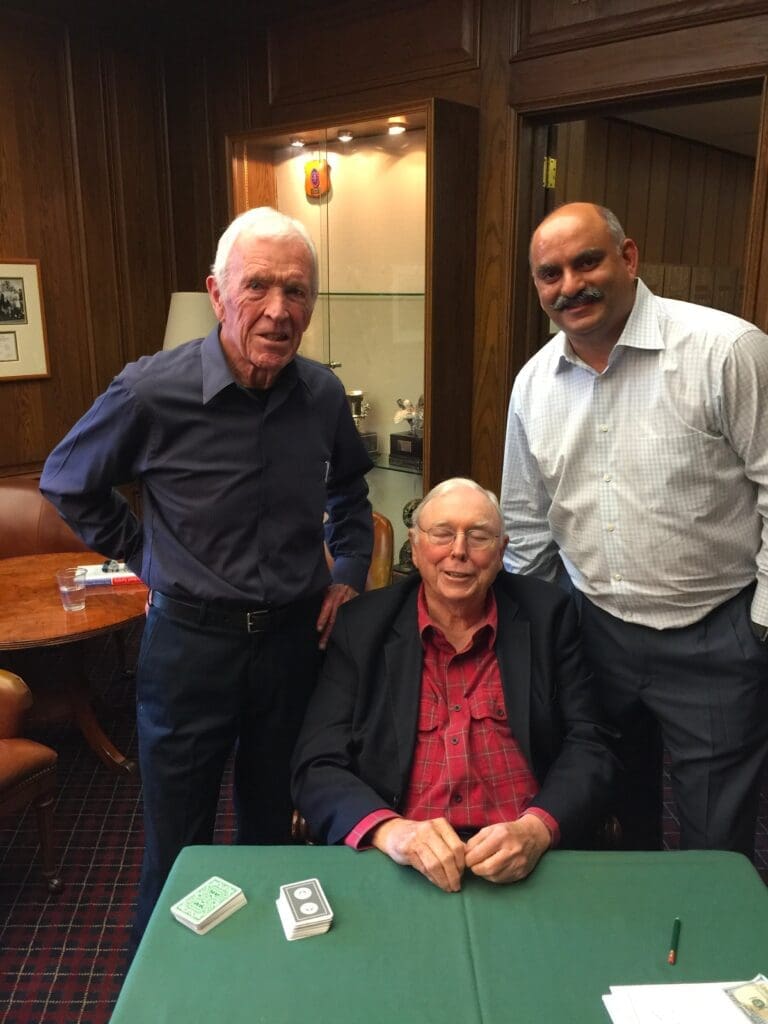

Guerin’s story is a powerful reminder that patience is the foundation of sustainable success in investing. Despite his early setbacks, Guerin lived life fully, playing bridge with Charlie Munger and Mohnish Pabrai into his later years. When he passed in 2020, Pabrai remembered him as a “wonderful soul” who lived on his own terms—a testament to the idea that success is about more than wealth; it’s about embracing passions and learning from mistakes.

Key Takeaways: Why Patience Matters

- Avoid Leverage: Using margin or leverage can amplify gains, but it also magnifies losses and emotional stress. As I learned the hard way, it can lead to panic-driven decisions.

- Embrace the Long Game: Warren Buffett’s advice to focus on the long term is timeless. Success in investing isn’t about quick wins; it’s about consistent, disciplined decision-making over decades.

- Learn from Mistakes: Both Guy Spier and Rick Guerin’s stories show that mistakes are inevitable, but they’re also opportunities for growth.

Final Thoughts From Guy Spier’s Book

Reading The Education of a Value Investor was a humbling and enlightening experience. Guy Spier’s transparency about his own journey reminded me that the path to success is rarely linear. It’s messy, emotional, and often requires us to confront our own vulnerabilities.

For anyone starting their investing journey—or even seasoned investors looking for a refresher—I highly recommend Spier’s book. It’s a masterclass in the importance of patience in investing and a reminder that the best decisions are often made with a calm, long-term perspective.

If you enjoyed this post, feel free to explore more insights on my website. I also wrote another post on a key lesson I took away from reading Guy Spier’s book—check it out!