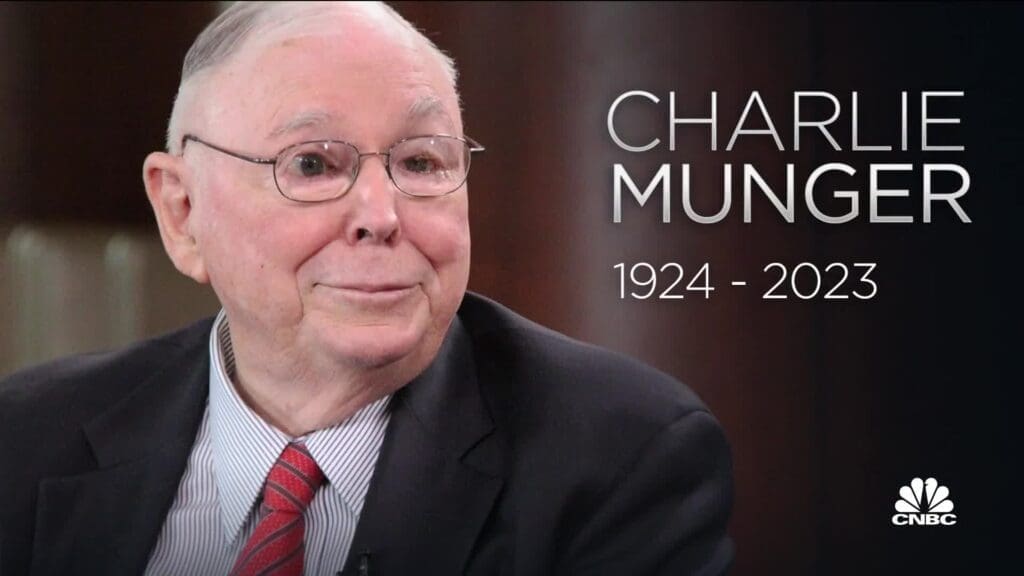

In Part 1 of this series on Charlie Munger’s investment psychology, we explored 12 psychological tendencies that influence our investment decisions. These insights from Poor Charlie’s Almanack reveal how deeply ingrained biases can subtly guide our actions, often without us realizing it. Understanding these psychological pitfalls helps us make wiser choices that align with long-term investing goals.

Now, in Part 2, we’ll look at 13 more tendencies that Munger considers essential to recognize and manage. By mastering these insights, we can become more resilient investors, avoiding costly mistakes and building stronger portfolios. If you’re ready to put these principles into practice, consider joining my free 2-hour investing masterclass for hands-on guidance and connect with our community through the Arigato Insiders Newsletter, where I share practical resources inspired by the timeless wisdom of Buffett and Munger.

Applying Charlie Munger’s Psychology to Investments 13. Overoptimism Tendency

Optimism can be a powerful motivator, but in investing, unchecked optimism often leads to risky choices. During market booms, it’s easy to assume prices will keep rising indefinitely, which can cloud judgment and cause us to overlook red flags. Charlie Munger’s investment psychology advises balancing optimism with a dose of caution. By staying grounded and looking at data objectively, we can ensure that our decisions are well-rounded and sustainable.

Applying Charlie Munger’s Psychology to Investments 14. Deprival-Superreaction Tendency

Loss aversion is a common psychological bias, leading us to react more strongly to the thought of losing something than to the potential for gain. For investors, this tendency often results in clinging to a losing stock, hoping for a rebound rather than cutting losses. Munger encourages us to evaluate each investment decision based on its current and future potential, not just past performance, allowing us to let go of what no longer serves us.

Applying Charlie Munger’s Psychology to Investments 15. Social-Proof Tendency

Following the crowd can be tempting, especially in investing, where market trends seem like a reliable indicator. However, as we saw in the dot-com and housing bubbles, this “herd mentality” often leads to speculative bubbles and poor outcomes. Munger emphasizes the importance of independent thinking and critical research. For more on building confidence in decision-making, join our Telegram community, where we regularly share insights and discuss the benefits of thinking independently.

Applying Charlie Munger’s Psychology to Investments 16. Contrast-Misreaction Tendency

When comparing investment options, we often focus on recent performance, ignoring other critical factors. For instance, choosing one stock over another just because it performed better last month might overlook long-term potential. Munger advises us to evaluate each investment individually, considering its own merits, which prevents us from falling into contrast-misreaction traps.

Applying Charlie Munger’s Psychology to Investments 17. Stress-Influence Tendency

When faced with stress, our tendency is to relieve the discomfort quickly, often through impulsive decisions. In investing, this might mean panic-selling during a downturn. Munger advocates for a calm, clear-headed approach, especially in challenging times. In my free investing masterclass, we explore strategies to manage emotions and make thoughtful choices, even during volatile market conditions.

Applying Charlie Munger’s Psychology to Investments 18. Availability-Misweighing Tendency

We tend to give recent or vivid information undue weight. For example, hearing about a friend’s big win in cryptocurrency might lead us to overestimate our chances of similar success. Applying Charlie Munger’s psychology to investments teaches us to seek insights from a diverse set of sources, helping us keep a balanced perspective and avoid placing too much emphasis on isolated events.

Applying Charlie Munger’s Psychology to Investments 19. Use-It-or-Lose-It Tendency

Investing is a skill that requires ongoing practice. Without regular engagement, our knowledge fades, leading to less informed decisions. Munger highlights the importance of continuous learning and staying connected with the market. Joining my Arigato Insiders Newsletter provides you with ongoing resources and insights to keep your investing skills sharp and adaptable, helping you stay on top of your game.

Applying Charlie Munger’s Psychology to Investments 20. Drug-Misinfluence Tendency

Our clarity of mind impacts our decision-making quality. Even common substances, like caffeine or alcohol, can subtly affect our thinking. Munger suggests making important investment decisions when we’re clear-headed and focused to minimize risks. Creating habits that promote clarity can enhance our overall investing mindset.

Applying Charlie Munger’s Psychology to Investments 21. Senescence-Misinfluence Tendency

As we age, we might become more resistant to new information or strategies. This tendency can lead us to rely on outdated techniques or ignore evolving market trends. Munger champions lifelong learning and adaptability, which allows us to stay relevant and informed as investors, regardless of age. This open mindset is a valuable part of Charlie Munger’s investment psychology approach.

Applying Charlie Munger’s Psychology to Investments 22. Authority-Misinfluence Tendency

Deference to authority figures can sometimes lead us down the wrong path. We might invest in a stock simply because a famous investor or analyst recommends it, without fully understanding the reasoning behind it. Munger teaches the value of doing our own research and ensuring each decision aligns with our unique financial goals. Trust in experts is valuable, but we must remain discerning.

Applying Charlie Munger’s Psychology to Investments 23. Twaddle Tendency

In a world of information overload, it’s easy to get distracted by irrelevant data or sensational headlines. For investors, this can mean focusing on short-term noise rather than long-term value. Munger advises us to concentrate on high-quality information that truly matters to our investing strategy, helping us make better choices by filtering out unnecessary noise.

Applying Charlie Munger’s Psychology to Investments 24. Reason-Respecting Tendency

Humans respond well to logic and reason, and applying these principles to our investment decisions can ground us in rational thinking. Munger emphasizes the importance of questioning whether each choice “makes logical sense” and aligns with our financial goals. Consistently asking questions like these helps us avoid emotional mistakes, anchoring us in clear, reasoned decision-making.

Applying Charlie Munger’s Psychology to Investments 25. Lollapalooza Tendency

This final tendency, which Munger calls the “Lollapalooza Effect,” describes situations where multiple biases converge, amplifying their impact. In speculative bubbles, for example, social proof, overoptimism, and authority influence may all come together, leading to irrational investing behavior. Recognizing when multiple biases are in play helps us resist groupthink and stay true to our principles, even when others are swept up in the hype.

Final Thoughts

Understanding these 25 psychological biases, as outlined in Charlie Munger’s investment psychology, equips us with a powerful toolkit for self-awareness and better decision-making. By recognizing and actively countering these tendencies, we can approach investing with a clearer, more grounded mindset, ultimately making decisions that lead to more consistent results.

For those ready to put these principles into action, join my free 2-hour investing masterclass, where we’ll apply Munger’s insights to real-world scenarios and build confidence in managing our portfolios. Don’t forget to subscribe to the Arigato Insiders Newsletter and join our Telegram community for ongoing learning, support, and practical resources to help you navigate your investing journey. Let’s grow together in the Munger way, building a foundation of lasting wisdom!