While Nvidia may currently be in the spotlight for its advancements in artificial intelligence (AI), astute investors should not overlook TSM stock (Taiwan Semiconductor Manufacturing). Here’s why…

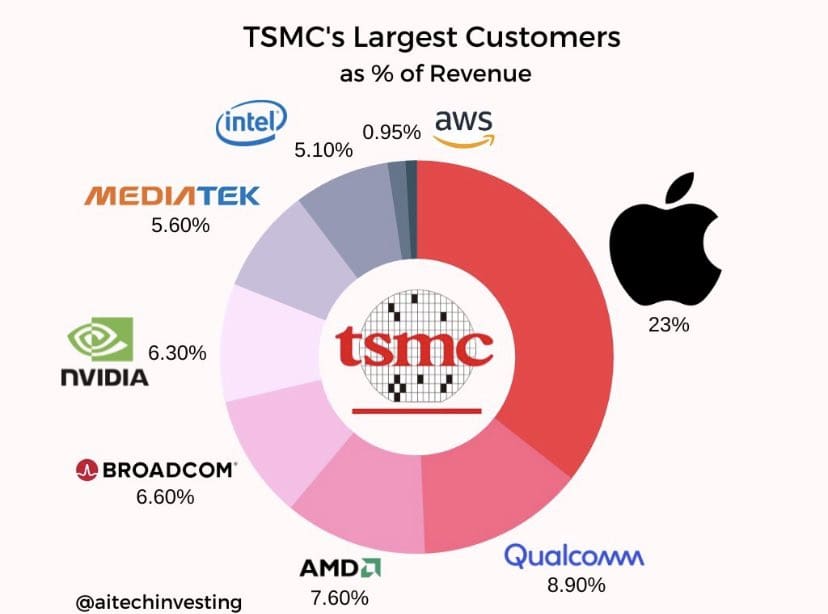

The surge in Nvidia’s stock has caused a ripple effect, boosting chip stocks globally. The reason behind this is quite simple: Nvidia doesn’t manufacture its own chips. Instead, it relies on TSMC, which is widely recognized as the most advanced chipmaker worldwide, to produce its GPUs.

Nvidia’s optimistic forecast for the second quarter has fueled expectations of increased orders with TSMC. As a result, investors have flocked to TSMC shares (ticker: TSM) as a way to capitalize on the growing demand for AI chips. Consequently, the stock has experienced an impressive gain of over 42% year-to-date.

TSMC’s primary driver of growth lies in high-performance computing. With the U.S. and Chinese internet giants increasingly developing their own cloud computing and AI chips, it is believed that TSMC will benefit from this trend in the coming years.

As one of the world’s largest contract chipmakers, TSMC makes integrated circuits for customers based on their proprietary IC designs. They have a reputation for producing high-quality chips that are used in a wide range of devices, from smartphones to cars to medical equipment.

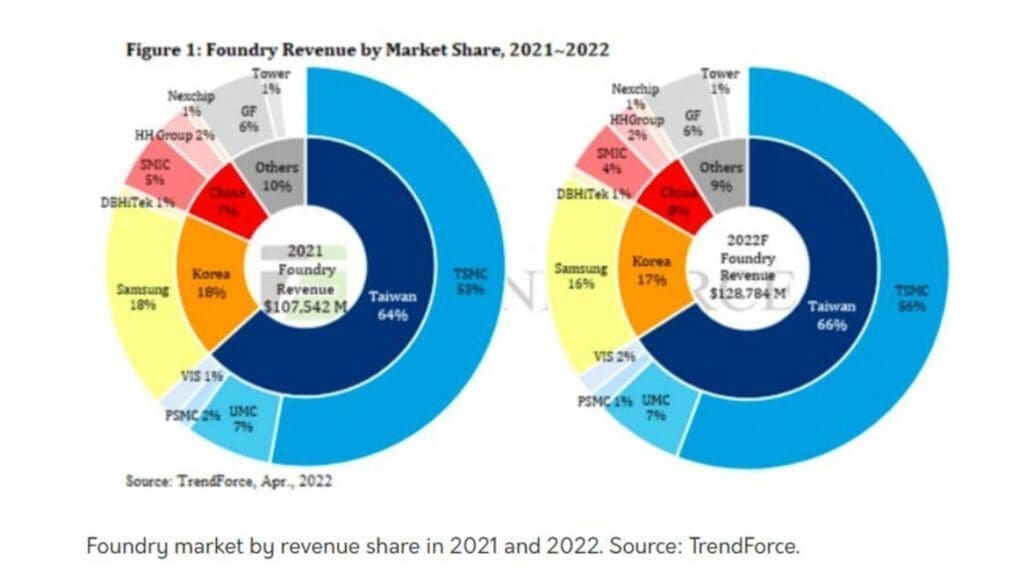

TSMC is known for its advanced manufacturing technology, which allows them to produce chips that are smaller, faster, and more energy-efficient than those made by many of its competitors. That’s why TSMC has consistently held the leading position in the foundry market in terms of revenue and market share over the past decade.

According to TrendForce, TSMC held 56% of the foundry market in 2022, which was more than the market share of its top four competitors combined.

However, it’s worth noting that Warren Buffett recently sold out his TSM holdings due to political risks. I have written a post in which I shared my investment thoughts on this matter and explained why I remain highly optimistic about TSM. Feel free to check out my video too.

In the meantime, investors should keep an eye on TSMC’s upcoming earnings announcement scheduled for July 20th. This will provide further insights into the company’s growth trajectory.

Get Up To $720 with MooMoo

If you are new to investing and are wondering what brokerage platform to get started, you can consider using MooMoo. Regulated by the Monetary Authority of Singapore, MooMoo is very user-friendly and offers $0 commission for both stocks and options.

Right now, you will even get $20 cash coupon when you deposit $100 inside! It’s an exclusive deal just for my readers!

That’s 20% return just by depositing!

Plus, you’ll also get free shares like Apple

Open your account here today!

Just came across your posting on TSMC. Thanks for it.

I wrote a chapter on TSMC as Buffett’s mistake by exiting it in my upcoming book – ‘The Intelligent Investor’s Mistake: Warren Buffett’.

You can get a copy of a sample of it at http://www.balajikasal.com.

Thanks so much for your insights!