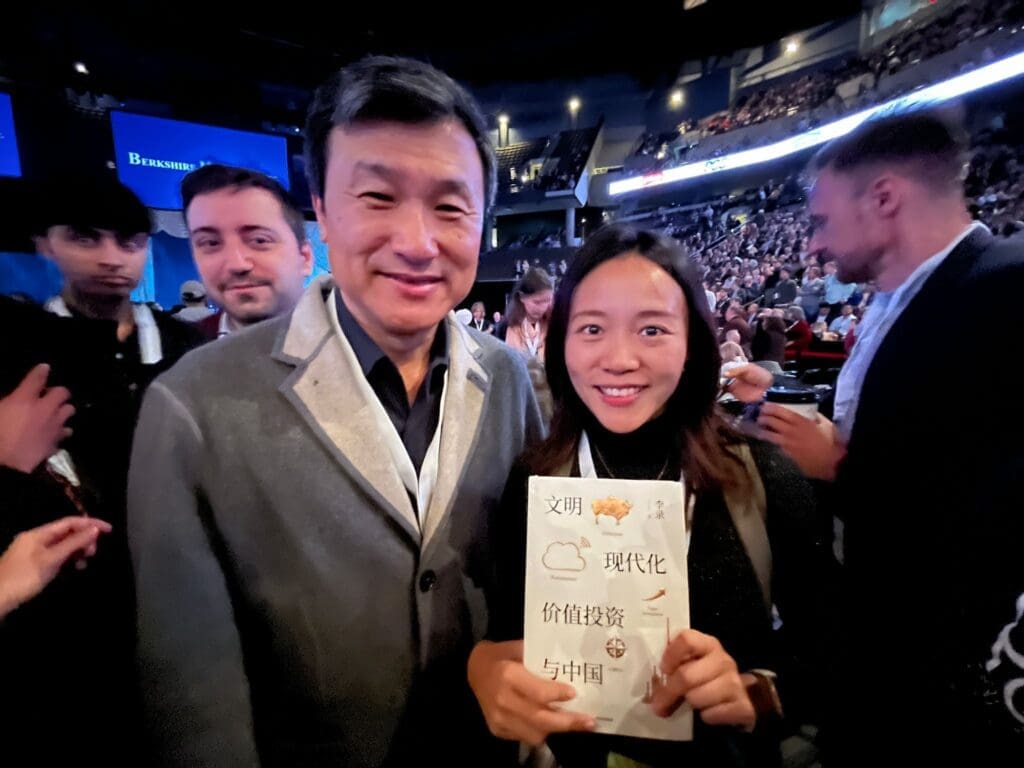

During my recent trip to the Berkshire Hathaway AGM, I had the honor of meeting Li Lu in person. When I saw him in the hall, he was already surrounded by a crowd eager to learn from the “Warren Buffett of China” by asking him questions.

Humility is the one word that best describes Li Lu.

Despite managing Himalaya Capital, a multi-billion dollar fund with a remarkable 30% compound annual return since 1998, placing him alongside Warren Buffett, Li Lu remains a grounded and humble person.

He repeatedly emphasized the importance of seeking truth in his investment research process. He stated, “You must seek truth like an investigative journalist. You must see yourself as a researcher, uncovering every single detail about the company.” Only then can you lower your probability of making mistakes and increase your chances of achieving outsized returns as a value investor.

This is the attitude I greatly admire. The dedication to truth and the insatiable curiosity to learn are incredibly rare. These traits are what make Li Lu, Mohnish Pabrai, Gautam Baid, Warren Buffett, and Charlie Munger great investors with exceptional returns.

Thanks to my friend’s recommendation, I started reading Li Lu’s book last year. It’s been a truly insightful read, helping me understand more about China and its future.

Li Lu’s book, “Civilisation, Modernisation, Value Investing and China,” is packed with investment wisdom, but for now, it’s only available in Chinese. Here are some key takeaways on investing, straight from his work:

Li Lu Lesson 1: Picking the Right Leaders Matters. But It’s Tough

Li Lu says good leadership is important. You’d either need to be a super good judge of character or know the leaders really well. Strong leadership can definitely help you predict how a company will do, but it’s not easy to assess accurately.

That’s why Li Lu admires people who are honest about the limits of their knowledge. They might say something like, “I can gather tons of information, and the company’s presentation might be slick, but I can only understand the leaders so much. It often feels like a show, so I just ignore it when making investment decisions.” Li Lu respects this kind of straightforward thinking.

Being a smart investor means being honest with yourself. You need to know what you know for sure, and even more importantly, what you don’t know. If you can’t be sure about the quality of a company’s leadership, don’t let it influence your decision.

Even though it’s challenging, Li Lu believes in taking a close look at a company’s leadership team, similar to how Warren Buffett and Charlie Munger do.

Here’s what Li Lu says: “The dream is to find the best companies with the best leaders, buy them when they’re on sale, and hold onto them for a long time.”

Li Lu Lesson 2: Why Investors Freak Out During Downturns (and How to Stay Calm)

Li Lu thinks investors panic during financial crises because they’re not honest with themselves about what they really know and what they’re just guessing about. To feel confident about your investments, you need to approach your research like a journalist, always searching for the truth.

Here is a question to ask yourself:

“Do you need to understand how the financial system solves its own problems before you can predict the business?”

Li Lu Lesson 3: How to Build Your Circle Of Competence?

The best way to learn about investing, according to Li Lu, is by getting your hands dirty in the real world. Pick a small business, a restaurant, or even a publicly traded company, and then research how it works:

* How does it make money?

* How it organises its financial structure?

* How do the leaders make decisions?

* How does it compare to its competitors?

* How does it adjust to changes in the economy?

* How does it handle extra cash and borrowing money?

Imagine you own the entire company. Even if you’re not running it yourself, wouldn’t you want to understand everything about it to protect your investment?

That’s the kind of deep understanding you need to make smart investment decisions.

Li Lu agrees with Buffett, who said: “I am a better investor because I am a businessman, and a better businessman because I am no investor.”

If you don’t understand how to read Chinese, I highly recommend watching Li Lu’s class for Columbia Business School students back in 2006. Though the video was filmed nearly two decades ago, the wisdom shared is timeless! Enjoy your learning!

If you enjoyed this article, I’m sure you’ll also love reading about my takeaways from William Green, the bestselling author of Richer, Wiser, Happier. Stay tuned for the next blog post to keep learning! Arigato!

All three takeaways are incredible and valuable to understand long term investing.

Thank you so much Kasi! I am glad you found the takeaways useful!