If you’re looking for timeless investment lessons from fund managers, you’re in the right place. I recently had the incredible opportunity to interview Matthew Peterson, a multi-million dollar fund manager known for his strategic and long-term approach to investing. The insights he shared were invaluable, and I’m excited to bring you the top nine lessons I learned from our conversation. These lessons can transform your investing journey, whether you’re just getting started or looking to refine your strategies.

1. Think Long-Term and Ignore the Noise

Matthew emphasized the importance of focusing on the long term, a classic investment lesson from fund managers who have achieved success. “There’s a lot of short-term noise that will distract you from the long-term objectives and goals,” he said. His advice is simple but powerful: filter out the daily fluctuations and market noise. Instead, stay committed to your long-term objectives. This strategy has been the foundation for many successful investors, and it can work for you too.

2. Start Early and Compound Consistently

One of the fundamental investment lessons from fund managers is the power of compounding. Matthew shared a story from his childhood, when he was already exploring ways to grow his money. “When I was even a child, I was trying to compound capital by going to different banks and trying to get higher interest rates,” he told me. The takeaway here is that it’s never too early to start investing. Whether you’re a beginner or experienced, consistent compounding can make a significant difference over time.

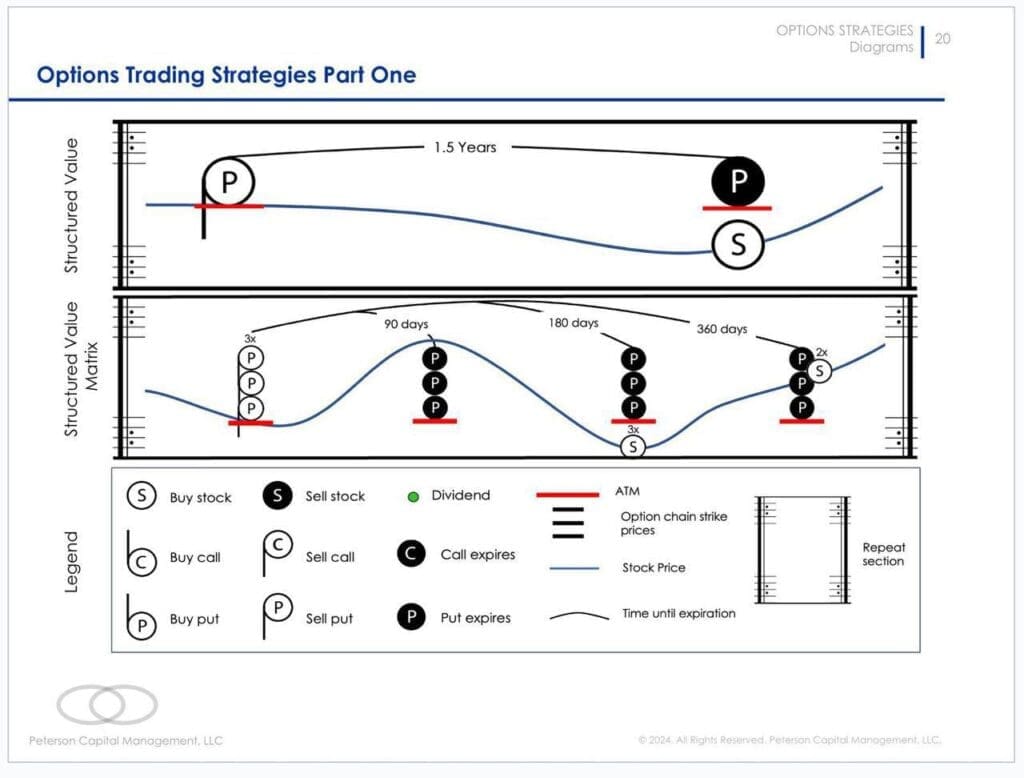

3. Use Options to Generate Cash Flow Safely

Another crucial investment lesson from Matthew was the strategic use of options to generate additional income. I’ve personally used put options for years to create steady cash flow and enhance the returns on my portfolio. “The focus is really on long-term value creation,” Matthew highlighted, and using options safely is one way to achieve that. By selling put options on stocks or ETFs you’re already interested in owning, you can collect premium income while waiting for the right buying opportunity. If this sounds intriguing, join my FREE 2-hour Options to Freedom Masterclass to learn how you can start using options safely in your investment strategy.

4. Stay Within Your Circle of Competence

Matthew stressed the importance of investing within your “circle of competence,” a common theme among successful fund managers. He spoke about knowing your strengths and areas of expertise. “If you don’t understand an investment, don’t venture into it. Focus on what you know, and get really good at it,” he said. This investment lesson is all about staying grounded and avoiding the temptation to jump into trendy but unfamiliar investments. Focus on what you know best, and you’ll be more successful.

5. Protect Your Downside First

One of the most critical investment lessons from fund managers like Matthew is risk management. “The first rule of investing is not to lose money,” he stated, echoing Warren Buffett’s famous advice. By focusing on managing risks first, you create a solid foundation that allows your portfolio to grow steadily. Remember, protecting your investments should always come before chasing gains.

6. Embrace Market Cycles as Opportunities

Matthew’s perspective on market volatility is one of the key lessons that set successful fund managers apart. Rather than fearing downturns, he sees them as opportunities. “Market cycles are a natural part of investing,” he explained. “The key is to be prepared when opportunities arise.” Being ready for these cycles allows you to take advantage of undervalued companies when the timing is right—turning market fluctuations into profitable entry points.

7. Diversify, but Don’t Overdo It

When it comes to diversification, Matthew offers a balanced approach. He supports diversification as a way to manage risk but warns against over-diversifying, which is a common pitfall. “It’s important to have a balanced portfolio, but too many positions can dilute your returns,” he mentioned. The lesson here is to focus on a few high-conviction investments that you understand deeply. This is how many fund managers build a robust portfolio while maintaining simplicity and focus.

8. What to Invest In: S&P 500 and Berkshire Hathaway

For retail investors who don’t have access to large funds or professional management, Matthew recommended a straightforward approach: “A balanced mix of 50% S&P 500 and 50% Berkshire Hathaway is an excellent strategy for long-term investors.” This blend provides exposure to the broad market’s growth while also leveraging Warren Buffett’s expertise. It’s a simple, low-cost strategy that works for investors seeking steady growth over time.

9. Stay Curious and Keep Learning

Finally, one of the most valuable investment lessons from fund managers is the importance of continuous learning. Matthew shared his own commitment to growth, despite his success. “The market is always evolving, and there’s always something new to learn,” he said. This mindset is what keeps successful fund managers ahead of the curve. By reading books, attending courses, and staying curious, you can continue to develop your skills and make better investment decisions.

Final Thoughts

The investment lessons from fund manager Matthew Peterson have given me so much to reflect on. From focusing on the long term to leveraging options for cash flow, his strategies are timeless and actionable. If you’d like to learn more about Matthew Peterson and his investment philosophy, check out his Peterson Capital Management website. There, you’ll find valuable resources and insights directly from his fund’s perspective. And remember, if you want to explore options strategies like the ones he shared, sign up for my next free 2-hr options masterclass to get started!

If you’re excited to dive deeper into these investment lessons from Matthew Peterson, you won’t want to miss the full interview! 🎥 Head over to my YouTube channel, where we discuss even more insights on navigating market volatility, using options safely, and building a strong, long-term portfolio. Watching the full interview will give you an in-depth look at the strategies that have helped successful investors like Matthew achieve consistent returns. Don’t forget to like, subscribe, and leave your thoughts in the comments—I’d love to hear what you think!