The economic situation seems to be a lot more challenging in 2023. You are wondering how to make more passive income so you can provide more for yourself and your family amid this rising inflation. Additional a few thousand dollars in passive income every single month, is that even possible? It’s totally possible and this is what I have been doing for the past 2 years, and I’m going to show you the 7 ways to make passive income to help you get started step-by-step. (flexoffers)

7 Ways To Make Passive Income No.1 – Options

I have been using options for years to generate passive income. One of the best ways to do that is to use B.O.S.S. options strategies, which is to sell put options. By doing so, you become the insurance company of the stock market, and you get to promise to buy stocks that you want at a price that you like. In return, you’ll get to collect passive income called premiums.

Just to clarify passive income is different from capital gain. If you own 100 shares of Amazon and the stock price shoots up from $90 to $180, that 100% gain is not passive income. That’s considered a capital gain and provided if you sell it off.

Passive income means you don’t need to do anything, yet the money is indeed inside your pocket!

So the premium you collect from selling puts is passive income because it really goes into your brokerage account.

Depending on the market conditions, you can potentially generate 1-5% every month by selling put options. Especially during uncertain times like this, options sellers like us will get to earn more premium than usual, and this is what I have been doing for the past few months selling put options to collect passive income every single month.

For example, just on this ETF called SPYG alone, I have been able to collect hundreds of dollars per month!

If you are new to options and want to use options to profit and protect your portfolio, do join us in our upcoming Free 2-hr Next Level Options Masterclass. We will share with you 3 different options strategies to take advantage of in different market conditions.

7 Ways To Make Passive Income No. 2 – Dividends

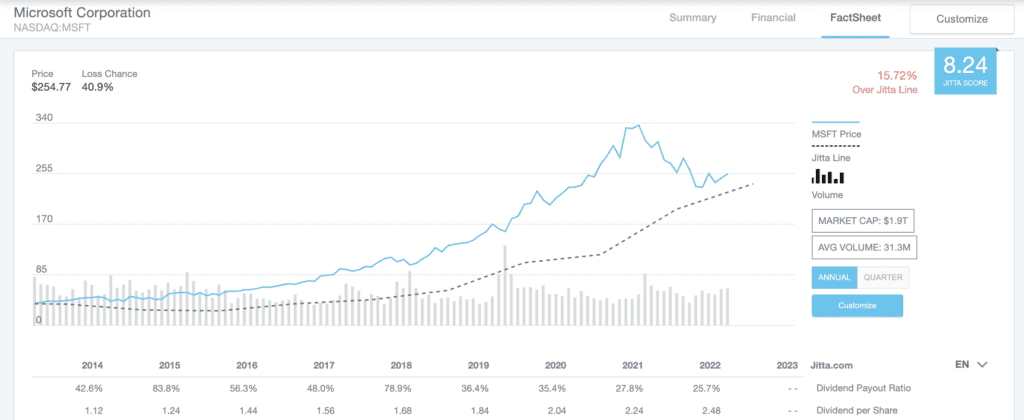

Apart from options, I also buy a lot of stocks for long-term capital gain and dividend passive income. What are dividends? It is a sum of money paid regularly by a company to its shareholders out of its profits. When you are buying dividend stocks, it’s important to look at how consistent the profits is the company making, and how consistent the dividend is growing over the years.

I typically like to buy companies that give more and more dividends over the years, and also within a very reasonable payout ratio. Payout ratio is the proportion of earnings paid out as dividends to shareholders. Anything more than 100% means the company is paying more than what it actually earns, which is not healthy in the long run. So make sure the payout ratio isn’t too high to ensure the sustainability of the dividends you are going to receive in the long run.

By the way, I also wrote a post to reveal the Top 100 Dividend Stocks That Beat S&P500. Check it out!

7 Ways To Make Passive Income No. 3 – Youtube

By now you should already know, content creators like us can make passive income on Youtube via videos like this. The beautiful thing about monetization on Youtube is, you just need to do the work 1 time, which is to produce and upload this video 1 time, and if people continue to watch your video later, you can use it to create a lifetime of a passive income!

That’s why I have videos that I created many years, still making money today! For now, I am making about $150 from youtube income per month!

Of course, I am still a very small fry and I do hope to grow bigger over time, so that’s why I will highly appreciate it if you can hit the subscribe button and give me a thumbs-up! 😀

That aside, I heard there are many big YouTubers out there making millions just from google ads sense alone. So ask yourself, if you were to create a channel, what kind of content are you going to produce?

7 Ways To Make Passive Income No. 4 – Affiliate marketing

Another way I’ve been using to make passive income is affiliate marketing. Every day, advertisers are finding ways to reach out to more people to try out their products and services. And if you have a YouTube channel or a place for people to follow you, you can promote products or services that you believe can bring value to your followers!

For example, I’ve been actively helping Webull to promote because I personally use their brokerage platform and I find it very useful. So next time you ever find a product or service you truly enjoy using, you can search their websites and see if they have any affiliate programs. You never know, you may just unlock a few hundred to a thousand dollars of referral passive income from there!

By the way, WEBULL IS GIVING AWAY 5 FREE SHARES WORTH UP TO $500 USD just by you signing up and funding ANY amount (YES, EVEN $1 ALSO CAN). The stocks include tech giants like Apple, Tesla, Google, and Amazon! Sign up now before the offer expires end of this month!

7 Ways To Make Passive Income No. 5 – Sponsorship

Once you reach a certain amount of followers, advertisers will start reaching out to you for sponsorship. And you don’t have to be super big with millions of followers to do that. All you need is to have a certain niche and an engaged following of a few thousand people.

Apart from this Youtube channel, I have a TikTok account with 230k followers, and a Telegram channel of about 5k followers for me to add value to my followers in the area of investing. That’s why I will also receive sponsorship deals that give me about 4 figures of passive income.

So if you want to receive sponsorship, then do start a channel and embark on a journey to become an online creator!

7 Ways To Make Passive Income No. 6 – Online Course

Apart from promoting people’s products, you can also promote your own products. And in my opinion, the best hassle-free product you can create is online courses, where people can pay and learn from you!

I know you must be thinking: “But I am not an expert in any area, what am I going to teach?”

I truly believe that everyone has expertise. It doesn’t mean that you must have a master’s degree before you can teach, just like your mum doesn’t need a master’s degree to teach you cooking. As long as you are good at something, and you are better in that area than somebody else, you have certain knowledge and skillset to offer! All you need to do is to start branding yourself online, so people can see how you can help them, and eventually be willing to pay you to learn from you!

And if you also want to learn how to create and market your own online courses to make an additional 4-5 figures per month, you can join us in our Free 2-hr Creator Masterclass to get started.

7 Ways To Make Passive Income No. 7 – Property rental

Lastly, if you have a property, you can also create passive income by renting out your property. I bought my first private property in Singapore a year ago, and I will soon receive my house next year. Instead of staying inside, what I am going to do is to rent it out to collect monthly passive income to pay for my mortgage.

The last I heard, the condo around the area I bought, can rent out for over $4000 per month. But of course, this $4K is not actual cash flow, because I will still need to cover my mortgage and property-related expenses. Hopefully, I can have a few hundred dollars of passive income from there!

So here are the 7 ways to make passive income. I believe as long as you are willing to press on in your pursuit, you will receive your 4-figure or even 5 or 6-figure passive income one day!

In the meantime, if you want to learn what options trading strategies really work, feel free to explore the rest of the website to learn more! Let’s continue to grow together on this learning journey!

Hi, Chloe. Admire ur passive income build up n thks for sharing. Hw do u build up ur capital in order to grow more into passive income.

If I hv debts to pay off n monthly able to save $100 but not every mth. Some time per mth able save $100 so hw do I build my income in order to hv money to grow into passive income.

Hi Onion Rings, I will suggest the first thing to do is ensure you don’t anyhow incur bad debts again (there are good debts vs bad debts), that means you want to watch out for unnecessary expenses like dining out/shoppings. Secondly I will suggest increasing your earnings power, by starting a side hustle like launching your online courses or build your own channel, so you can increase your passive income streams. Then when you have more funds like a few thousands, start investing! Hope it helps!